Announcements

Drinks

European ESG corporate bonds: pick-up expected after slow 2023

“We believe the increase in ESG issuance will partly be driven by a mild recovery in volumes from the real estate sector, which is facing significant refinancing requirements this year. Further support in the second half of the year may also come from anticipated interest-rate cuts,” said Eugenio Piliego, a corporate analyst.

Issuance of new European ESG-linked international corporate bonds rose almost 25% in January 2024 y-o-y to USD 24bn-equivalent. Even so, ESG-linked flows were not able to keep up with rampant supply in the bond market overall propelled by the rally in yields and spreads: European corporate issuance rose by 47% y-on-y in January so proportionally the share of ESG bonds fell to 35% from 43%.

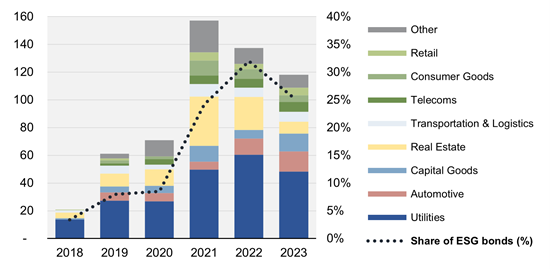

Last year, European corporate ESG-linked bond issuance fell around 15% to approximately EUR 120bn whereas overall bond issuance rose 7%. Issuance of sustainability-linked bonds was weak, contributing to the decrease. SLBs have come under tough scrutiny for increasing the risk of greenwashing.

European ESG-linked corporate bonds accounted for 25% of all European non-financial corporate bonds issued last year compared to 32% in 2022. “But while the proportion of ESG-related bonds in Europe fell, activity was still significantly above the 4% in both North America and Asia,” Piliego noted. “Europe’s leadership in ESG bonds looks unbeatable for now.”

European ESG corporate bonds by volume (EUR bn) and sector per share (%) of total issuance

Source: Bloomberg, Scope Ratings

Utilities have historically been the most active issuers of ESG-linked bonds but even though the sector still led ESG-linked corporate bond issuance in Europe last year (40% of the total), absolute volumes suffered thanks to a decline in issuance by major issuers such as Tennet and ENEL (the latter issued a EUR 1.75bn SLB in January 2024). ESG bonds accounted for 49% of the volume of total bond issuance from the sector down from more than 60% for the past two years.

ESG bonds from real estate issuers have historically seen the second largest volumes after utilities. But issuance collapsed in 2023, falling by more than 60% to EUR 8.6bn whereas total issuance of European real estate bonds rose by 8%. The decline was particularly evident in Germany, where not a single new ESG bond was issued. Capital-intensive sectors like automotive and capital goods saw notable increases in the weight of ESG bonds issued. ESG-linked bonds made up 27% of automotive bond new issues in terms of volume and 12% in terms of number of bonds issued.

“On the investor side, greenwashing concerns led to lower demand for ESG bonds, as did diminished yield advantages,” said Anne Grammatico, a corporate analyst. "But while greenwashing concerns have led to the disappearance of a significant greenium, this is not necessarily a long-term feature. Progress towards further a more standardised and transparent framework and enhanced credibility towards issuer's commitments to sustainability could revive pricing advantages to conventional bonds.”

Download the full report here.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.