Announcements

Drinks

Cyprus: sound economic and fiscal outlook, improving banking sector sustain credit fundamentals

Thibault Vasse, Associate Director and Alessandra Poli, Associate Analyst

Thibault Vasse, Associate Director and Alessandra Poli, Associate Analyst

The Cypriot economy outperformed expectations last year, with growth of 5.5%, above consensus forecasts and the government’s 2021-24 Stability Programme forecast of 3.6%. Unemployment has dropped to 5.4% in April 2022, the lowest level since 2009. The steady economic recovery also supported a swift improvement in Cyprus’s fiscal fundamentals as the budget deficit narrowed sharply to 1.7% of GDP in 2021 from 5.8% of GDP in 2020 and a 4.7% target in the Stability Programme.

The robust rebound in economic activity reflects the government’s effective policy response during the height of the Covid-19 pandemic that helped avoid large-scale job losses, bankruptcies, and structural damage to the economy’s growth potential. We expect growth of 2% in 2022, followed by around 2.7% over 2023-26.

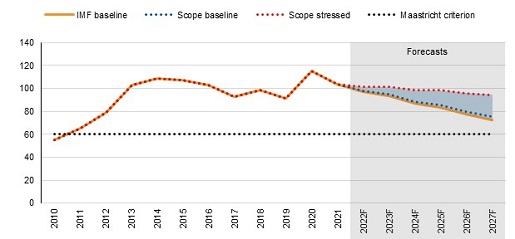

Gradual withdrawal of Covid-19 support measures and strong economic growth will support a return to budget surpluses by as early as 2024 and thus contribute to a firm decline in the public debt-to-GDP ratio to 75% of GDP by 2027, from a peak of 115% of GDP in 2020 (Figure 1). Importantly, our stressed scenario, which includes a combination of macro-economic, fiscal and interest rate shocks, would still result in a declining public debt-to-GDP ratio, albeit at a more moderate pace.

Figure 1. Cyprus’s debt sustainability analysis

% of GDP

Source: IMF, Scope Ratings

The government’s record of fiscal prudence that supported a steady reduction in the debt-to-GDP ratio following the 2012-13 financial crisis – from the 2014 peak of 109% to 91% in 2019 - and its renewed commitment to fiscal discipline underpins our confidence in this favourable debt trajectory.

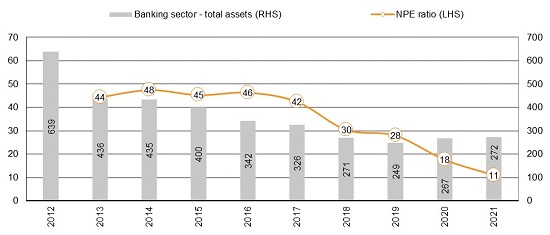

Another important structural improvement has been the considerable reduction in risks for the sovereign stemming from the banking sector over the last decade. After the 2012-13 domestic financial crisis and the peak in the non-performing exposures (NPE) ratio recorded in 2014, the government has taken multiple steps to enhance NPE management. The NPE ratio continued to decrease despite the Covid crisis, falling to 11% in 2021 from 48% in 2014 (Figure 2). Cyprus’s previously outsized banking sector has shrunk too, with total assets now more in line with the EU average at 272% of GDP in 2021, down from 639% in 2012.

Figure 2. Cyprus’ banking sector resilience

% of total loans (LHS); % of GDP (RHS)

Note: data for NPEs is available from September 2013

Source: Central Bank of Cyprus, ECB, Scope Ratings

Overall, Cyprus has made important strides in terms of addressing legacy credit weaknesses such as weak public finances and fragilities in the banking sector through structural reforms and prudent fiscal management over the past years. The country is well positioned to reverse the deterioration in its fiscal fundamentals observed during the Covid-19 crisis and to face future shocks.

The country’s sound reform momentum and proven capacity to tackle structural issues underpins our confidence in Cyprus’s long-term prospects. The effective delivery of investments and reforms outlined in the National Recovery and Resilience Plan totalling EUR 1.21bn (about 5.2% of 2021 GDP), will be critical in supporting long-term growth and addressing lingering structural challenges.

Still, several challenges remain, including high public-sector and private sector indebtedness, large external imbalances and elevated NPEs. Russia’s war in Ukraine war has increased uncertainty and weighs against the otherwise favourable outlook. Cyprus has significant export exposure to Russia (8.4% of GDP), especially in tourism.

We revised the outlook for our credit rating for the Republic of Cyprus (BBB-) to Positive from Stable on 24 June.