Announcements

Drinks

Creating a BRICS reserve currency: a long-term project despite Russia’s de-dollarisation strategy

By Levon Kameryan, Associate Director, Sovereign Ratings

Russia and other BRICS members – Brazil, India, China and South Africa – each have different approaches to making changes to establish an alternative non-dollar-denominated international financial system, with Russia’s motives tied to the growing pressure on its capital account following its war on Ukraine that led to tougher international sanctions.

For the other BRICS – and countries aspiring to join the group including Egypt, Turkey, Algeria and, more recently, Saudi Arabia – de-dollarisation is a much less urgent goal. India has a closer relationship with the US than with some of the other BRICS members. Brazil and South Africa are less vulnerable to US sanctions. China and the US remain dependent on each other for trade – China was the US’s third largest trade partner in 2022 January-September after Canada and Mexico – diminishing the logic for third countries to abandon the dollar.

Western measures to isolate Russia also complicate closer cooperation within the BRICS+ countries because of the risk to others of secondary sanctions.

In addition, not all BRICS+ countries have the necessary financial resources or political incentive to invest in the creation of their own non-dollar market infrastructure. Indeed, the most powerful member states might promote the internationalisation of their own currency at the expense of others.

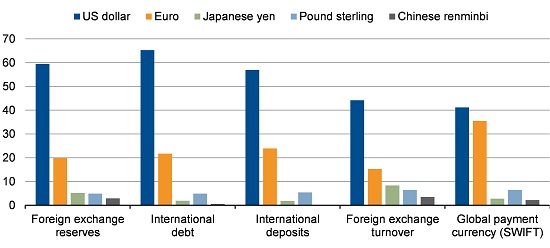

Figure 1. Dollar dominates international monetary system; euro a distant second

Currency composition of the international monetary system, %

Source: ECB (The international role of the euro, June 2022), BIS, IMF, SWIFT, Scope Ratings calculations.

Notes: The data for foreign exchange reserves are for the second quarter of 2022; International debt and international deposits data are for the fourth quarter of 2021; Foreign exchange turnover data as of April 2022; SWIFT data as of July 2022.

Renminbi, not rouble, natural but limited beneficiary of de-dollarisation

Any common de-dollarisation strategy would inevitably result in greater use of the Chinese renminbi, making the group more dependent on China’s economic policies and much larger economy, equivalent to almost 60% of BRICS aggregate output. China launched crude oil futures contracts denominated in renminbi in 2018, whose trading volumes are at times close to dollar contracts for Brent or West Texas Intermediate crude.

However, the Chinese currency lacks the international acceptance of the dollar or the euro (Figure 1). China’s central bank does not operate a fully floating foreign exchange regime with a lingering tendency of using capital account controls to manage currency flows, even after liberalisation steps taken.

The dollar remains the dominant currency in almost every area of the current global financial system, with the euro a distant second. It seems unlikely that another currency will overtake the greenback or the euro any time soon.

Challenging dollar hegemony would require a reorganisation of the international financial system, well beyond trade relations, including the roles of Western-led international institutions such as the International Monetary Fund and the World Bank.

Strong longer-term incentives for internationalising BRICS+ currencies

The BRICS+ group has good longer-term economic and political incentives for reducing the dollar's global dominance. BRICS countries account for 40% of the global population and one-third of the world economy in terms of purchasing power parity. With Saudi Arabia, BRICS would have two of the largest oil producers, Saudi Arabia and Russia, and two of the largest oil consumers, China and India, increasing the potential to price mutual oil sales in local currencies.

Trade turnover within the BRICS+ is likely to continue growing. China's foreign trade with other BRICS countries increased by 16% to USD 461bn in the first 10 months of this year compared with the same period in 2021, double the rate of overall growth rate of China's foreign trade during the same period.

This opens the door for the gradual development of a non-dollar secondary financial system, helping the countries extend their spheres of influence. We will likely see efforts to bring BRICS national non-dollar financial infrastructure closer together, to increase mutual trade settled in domestic currencies and to improve cooperation with regional intergovernmental organisations such as the China-led Shanghai Cooperation Organisation.

However, creation of a common BRICS currency that performs the role of the store of value or reserves for central banks of middle-income market economies will remain a long-term challenge.

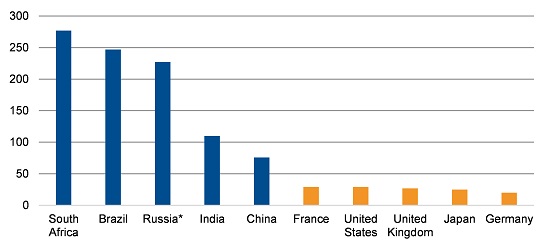

Figure 2. Risk premium: BRICS CDS spreads significantly wider than reserve-currency issuer countries

CDS spread (bps), five-year, USD, 1 December 2022

Source: Bloomberg, Scope Ratings. *The data for Russia from 1 February, 2022.

The market perception of risk, judged by sovereign credit default swaps for BRICS – even excluding Russia, which defaulted on its foreign debt in June – trades significantly higher than that for reserve-currency issuer countries (Figure 2). Most BRICS+ countries have good reasons to remain within western financial spheres if only through memberships of international financial institutions.