Announcements

Drinks

Poland: rule-of-law and monetary-policy weaknesses challenge ratings

By Dennis Shen, Director, and Brian Marly, Analyst, Sovereign Ratings

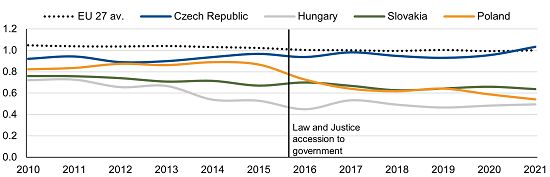

The stand-off between Warsaw and Brussels over violations of the rule of law, such as the threat to judicial independence, have long cast a shadow over Poland’s credit ratings, which we placed on Negative Outlook in Jan. 2022. Poland has experienced deteriorating governance standards for some time (Figure 1).

However, on top of growing concerns that the EU might block the release of funds for Poland are the economic consequences of Russia’s war in Ukraine, which have stoked inflation and contributed to growing cost-of-living pressures, in turn putting a premium on investment to maintain Poland’s growth momentum.

The EU’s referral last month of Poland to the Court of Justice of the European Union signals limited willingness on the part of the European Commission to soften its stance on the primacy of the rule of law. Poland might face additional monetary penalties from this infringement. This tough stance on the part of the EU contrasts with Poland’s enhanced strategic position within the EU’s overall strategic framework as one of Ukraine’s strongest supporters since escalation of war.

The Constitutional Tribunal of Poland, which has previously challenged the supremacy of EU law, is also embroiled in internal infighting over its president, so it is unclear when it will rule on judicial reform approved by the Polish parliament but referred to the court by Polish President Andrzej Duda.

Figure 1: Poland’s governance record continues to worsen

Index of World Bank Worldwide Governance Indicators*

*Average of scores for Voice and Accountability, Political Stability and Absence of Violence/Terrorism, Government Effectiveness, Regulatory Quality, Rule of Law, and the Control of Corruption. Source: World Bank, Scope Ratings.

Doubts over EU funding coincide with intense underlying inflationary pressure

At stake in the rule-of-law row are EUR 23.9bn in grants and EUR 11.5bn in loans to which Poland is entitled from the EU’s Recovery and Resilience Facility plus a separate sizeable tranche of European cohesion funding from the 2021-27 EU budget, equivalent to EUR 76.5bn, or 10.7% of average 2021-27 GDP. Poland is, in aggregate, the recipient of the largest nominal sums of any EU member state.

However, uncertainty instead surrounds whether any new EU funding, aside from the last 2014-20 EU budget monies, will flow to Poland ahead of coming elections. This uncertainty tempers our outlook for longer-run economic growth and impairs Poland’s fiscal trajectory as the government seeks to replace some delayed EU funding with more costly national financing.

Present uncertainty takes place against a backdrop of a poorer economic and inflationary outlook. We cut our forecast for Poland’s real GDP growth to around 0.8% for this year from a previous forecast of 1.5%, representing a slowdown from the 4.9% in 2022, although we expect a rebound in 2024 to 4.2%.

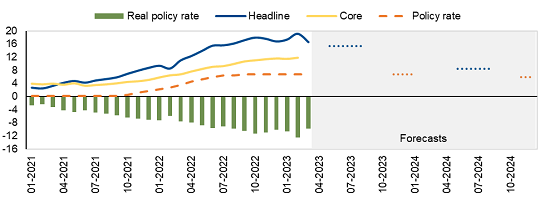

Headline inflation stands seven times above a 2.5% central-bank target. Core inflation has continued rising, signalling underlying domestic price pressures. Headline inflation will remain high – averaging 15.4% this year, up from 14.4% in 2022, before easing to 8.4% next year.

Nominal wage growth, running at 13.6% YoY as of February, is contributing to services-sector inflation. This reflects a tight labour market, with unemployment of 3.1%, near a historic low and below a structural rate of about 4.3% according to one central-bank estimate.

Figure 2: Consumer-price-index inflation diverges from Poland’s central bank policy

Inflation: year on year % change; policy rate: %

Source: Central Statistical Office of Poland, National Bank of Poland, Scope Ratings

Monetary policy decisions inconsistent with addressing inflation

Against this inflation outlook, the National Bank of Poland has held policy rates unchanged at 6.75% since September. This has shifted the real policy rate to a negative 9.5% (Figure 2) – among the lowest globally. We no longer expect a rate increase before elections this year.

Such an accommodative monetary policy challenges the credibility of the central bank in bringing inflation back to target.

Outstanding concerns around Poland’s institutions, the economy and price stability underscore risks for the ratings – due for review on 2 June.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.