Announcements

Drinks

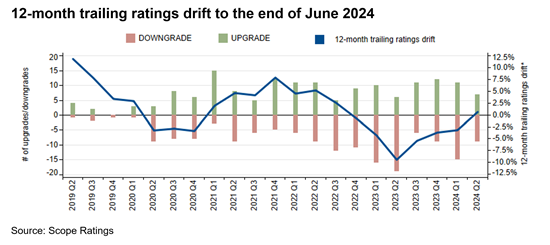

Structured Finance Activity Report: ratings drift shifts into positive territory

We monitored 314 instruments over the period, 13.1% of which were upgraded and 12.4% downgraded. The change in direction was mainly driven by less downward ratings pressure on CRE/CMBS and more upgrades on NPL transactions in the first quarter. Both factors significantly contributed to the constant decline between Q4 2021 and Q3 2023.

NPLs continued to see most of the downgrades, however, followed by CRE/CMBS. The two asset classes exhibit opposing trends, though. NPL downgrades increased (from 65% to 69%) while CRE/CMBS fell from 14% to 8%. NPL downgrades were mainly attributable to depressed sales prices, disappointing collections, and the general downward review of original business plans by servicers. In the case of CRE/CMBS, refinancing risk and depressed values against a backdrop of high interest rates continue to haunt the asset class.

Upgrades in the year to June were evenly distributed among sectors and were mainly down to deleveraging in the case of performing ABS, better-than-expected performance of unsecured NPL exposures, and transaction-specific structural changes and portfolio stabilisation in the case of CRE/CMBS.

In the year to June, Scope’s structured finance team covered 405 instruments across 179 transactions. The major asset classes were NPLs (104 instruments), Other (mainly Structured Credit, Reverse Mortgages, and Repackaged Notes, 77) and CRE/CMBS (57). At the end of Q2 2024, Scope had rated almost EUR 286bn-equivalent in structured finance instruments since 2014.

Download the full report here.

Webinar: And join us for our Data Centre Financing in Europe webinar on Tuesday, 15 October at 15:00 CEST to hear from Scope structured finance analysts Benjamin Bouchet and Adam Plajner, who will be joined by: Guillaume Genin, Director of Capital Markets, Vantage Data Centers; Tobias Butte, Director, Asset Securitisation, SMBC Nikko Capital Markets; and Syed Ahmed, Managing Director, Apterra Infrastructure Capital LLC.