Announcements

Drinks

EU’s complex plan to unlock frozen Russian assets is vital for financing Ukraine

By Dennis Shen, Scope Macroeconomic Council

The plan’s complexity stems from the EU’s efforts to avoid directly seizing the Russian funds to limit the reputational damage to the financial system and the euro and to sidestep potential court challenges. This approach allows Russia to retain legal claims, mitigating the divisive politics inside the EU that have delayed the activation of these reserves for years.

The plan aims to use the available cash balance generated by the frozen Russian assets, equivalent to around EUR 140bn. The plan would replace the balances generated by matured Russian assets with zero-coupon short-term EU bonds. The cash balance would be disbursed as zero-interest “reparations” loans to Ukraine conditional on reforms – repayable only if Russia ceases the war and compensates Ukraine for damages.

The EU hopes the outcome of European Council summit on 23 October will be an agreement on using the assets so work can start on a legal proposal for a mechanism releasing money by the second quarter of 2026. We expect some form of an agreement soon using the Russian money given the lack of a credible alternative.

No viable alternative to support Ukraine’s long-run financing needs

Activating more of the frozen Russian funds is critical because Western funding options for Ukraine are becoming increasingly constrained. The initial expectations of the IMF that the war would wind down by 2024 have proven too optimistic while western governments have already allocated EUR 321bn to Ukraine. Ukraine still faces a hefty financing requirement of around USD 50bn a year and more than USD 200bn by the end of the decade.

Western governments, which have increasing debt and military spending commitments of their own, appear less willing if not less able to continue funding Ukraine indefinitely. EU member states, collectively Ukraine’s largest single financier, risk domestic backlash should they shoulder more of the burden at the expense of cutbacks in domestic spending.

As a result, attention has shifted to using the frozen Russian assets. This ensures Russia pays for the war it started, easing the strain on western taxpayers. The G-7’s Extraordinary Revenue Acceleration (ERA) loan programme, which uses the interest from these reserves, marked the start of this shift, but its resources are nearly exhausted.

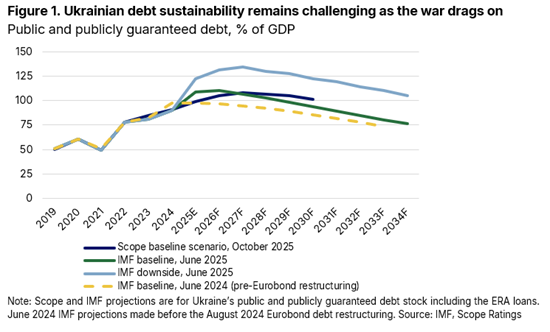

Short of outright defeat, it is unlikely that Russia would compensate Ukraine so the zero-coupon loans to Ukraine would serve effectively as grants, minimising the adverse impact on Ukraine’s public-debt sustainability and repayment capacity (Figure 1).

In addition, the EC wants to facilitate the renewal of the immobilisation of the frozen assets by a qualified majority of EU member states rather than the unanimity presently required, to preclude potential future vetoes that could scupper the programme.

EC working through member states’ concerns; UK participation adds value

Belgium has requested strong guarantees ensuring it would not be left alone covering potential litigation costs from Russia. This can be worked out.

Inviting global partners that also have frozen Russian assets to participate in the suggested instrument is a prudent approach. The British government has already presented a scheme that repackages around GBP 25bn of Russian assets as loans.

One suggestion from German Chancellor Friedrich Merz that the funds should only be used by Ukraine for procuring military equipment, and not for general budgetary purposes, may be too restrictive.

Ukraine faces a significant financing gap for non-military expenditure – such as covering the costs of pensions, public-sector wages and humanitarian aid – alongside that for military expenses.

The EC proposal may prove a more indirect yet effective channel of funding Ukraine

Under the plan, guarantees provided by the participating governments would act as a contingent liability and increase the implicit financial liabilities of participating central governments.

Nevertheless – given Ukraine’s significant funding requirements, if the EU does not find a way to mobilise the frozen Russian reserves, it would likely have to resort to alternative arrangements potentially calling even more on already stretched budgetary resources.

Such a contingent liability would prove a more indirect channel of financing Ukraine than relying on bilateral loans, grants from EU member states or EU-level loans absent the recourse to Russian money – potentially curtailing the ultimate liability for member states.

The Scope Macroeconomic Council brings together credit opinions from ratings teams across multiple issuer classes: sovereign and public sector, financial institutions, corporates, structured finance and project finance.