Announcements

Drinks

EU trade deals advance amid US protectionism, but intra-EU barriers remain key weakness

By Alvise Lennkh-Yunus, Sovereign and Public Sector

The EU’s latest trade agreement follows the conclusion of long-running negotiations over a free-trade agreement with the Mercosur countries of Latin America, although, like the EU-India deal, it still requires final ratification. These developments echo recent trade discussions between Canada and China.

However, the EU’s pursuit of external trade deals should not distract from the substantial reforms that member states still need to pass to reduce internal trade barriers.

As the IMF and the ECB have made clear, significant residual barriers in the European Single Market remain a structural weakness, reinforcing the case for deepening structural reforms and investments to boost strategic autonomy and resilience. The benefits of doing so for Europe’s economic growth and credit outlook would far exceed the impact of foreign trade deals particularly given the EU’s modest trade with India and Mercosur.

India trade deal has limited near term benefits, but significant opportunities long-term

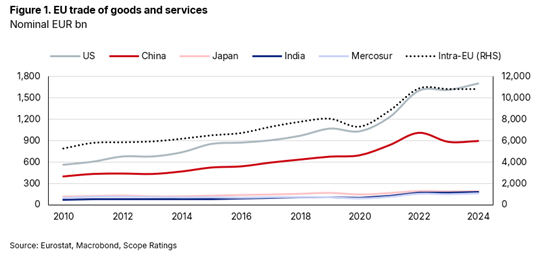

The EU’s trade with these two partners is significantly smaller than EU-US and EU-China commerce.

In 2024, EU trade volume with India was about EUR 190bn, somewhat above the EUR 168bn with Mercosur countries but significantly below trade volumes of about EUR 900bn with China and EUR 1,700bn with the US (Figure 1). Much will depend on the extent to which trade is diverted from China and the US.

Over the medium term, however, the potential of EU-India trade is much larger. The combination of India’s large market, strong growth fundamentals, and the inclusion of services in the deal – which opens EU access to important sectors such as financial services and maritime transport – should create significant opportunities.

New trade agreements provide modest support for European sovereign credit outlook

The agreement is expected to have a generally supportive but limited effect on EU sovereign credit risk profiles over the medium-term. There is significant uncertainty around the magnitude and timing of these effects, as the impact will be gradual, reflecting the phased reduction of tariffs.

Additional uncertainty arises from the consequences of heightened competitive pressures on the most exposed sectors, which are difficult to assess at this stage. Increased competition from Indian firms could weigh on certain EU sectors and potentially lead to shifts in production away from the EU, with uneven effects across countries and industries.

The exclusion of politically sensitive agricultural subsectors should help limit negative political and social repercussions given that European farmers’ opposition to the EU-Mercosur agreement has led to the long delays in the pact coming into force.

Europe’s capital goods sector set to benefit from India deal

Machinery and electrical equipment are likely to gain the most, followed by chemicals and combustion cars. Tariffs on cars are gradually going down from 110% to as low as 10%, while they will be fully abolished for car parts after five to ten years. Tariffs up to 44% on machinery, 22% on chemicals and 11% on pharmaceuticals will also be mostly eliminated.

Similarly, according to the European Commission, Indian tariffs on wines will be cut from 150% to 75% at entry into force and eventually to levels as low as 20%, tariffs on olive oil will go down from 45% to 0% over five years, while processed agricultural products such as bread and confectionary will see tariffs of up to 50% eliminated. Conversely, competition in textiles, wearing apparel, and ferrous metals may intensify, putting additional pressure on EU firms.

Export-orientated EU member states likely to gain most: Germany, France, and Italy

European countries that already hold significant market shares in India – notably Germany, France and Italy – are set to benefit most from the deal.

More broadly, countries with strong export-oriented manufacturing bases are well positioned to gain, particularly for those specializing in machinery and equipment and transport equipment, such as Germany and Austria, as well as those with strengths in chemicals and related industries, including Belgium and the Netherlands.

It is important to note that electric vehicles will be excluded from import duty reductions for the first five years. After that, EU imports will be restricted to a modest 160,000 for combustion engines and 90,000 for electric vehicles per year, limiting the overall uplift from tariff reductions in the automotive sector.