Announcements

Drinks

German regional development banks: low-risk despite structural challenges

Download the report here.

The two national and 17 regional development banks (Förderbanken) deliver essential, competition-neutral services with the primary aim of promoting regional development. In the Covid-19 crisis, the banks were key implementing partners for federal state (Länder) policies to protect businesses affected by the crisis. Their combined financial support to the German economy amounted to EUR 153bn in 2020 (4.6% of GDP) – EUR 27.3bn in grants, EUR 91.9bn in loans and EUR 34bn in guarantees and indemnities.

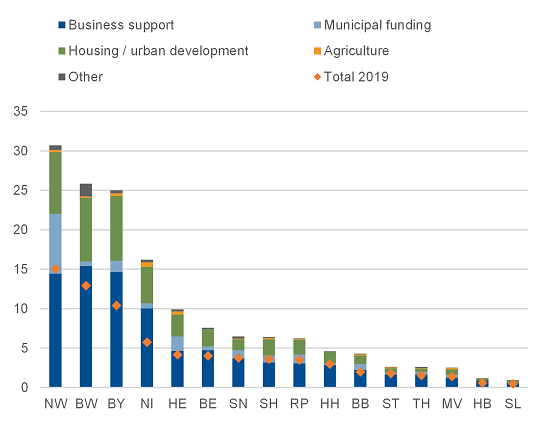

Financial support provided by Förderbanken in 2020 by sector

EUR bn and % of total

Source: VÖB, Scope Ratings GmbH. Note: Baden-Württemberg (BW), Bavaria (BY), Berlin (BE), Brandenburg (BB), Bremen (HB), Hamburg (HH), Hesse (HE), Lower Saxony (NI), Mecklenburg-Vorpommern (MV), North Rhine Westphalia (NW), Rhineland-Palatinate (RP), Saarland (SL), Saxony (SN), Saxony-Anhalt (ST), Schleswig-Holstein (SH), Thuringia (TH)

“Because of their robust balance sheets and conservative lending policies, the development bank sector weathered the Covid-19 shock well. This limits any associated contingent liability risks for Länder governments, which provide extensive guarantee frameworks,” said Julian Zimmermann, an analyst in Scope’s sovereign and public sector team. “This in turn ensures their access to capital markets on favourable terms. We expect the banks to continue to tap capital markets at very favourable rates, which will help keep refinancing rates low and support their main source of income: net interest income.”

Key factors contributing to the sector’s resilience are prudent business models with well-established links to bank partners and customers; robust balance sheets with high capitalisation and sound asset quality, strengthened by low-risk lending practices.

The most important factor supporting the development banks’ resilience relates to their prudent lending, which supports asset quality. For their earnings, development banks rely heavily on net interest income. Due to structurally low interest rates in recent years, net interest margins have been compressed and have declined over the past five years.

“The sector’s performance in terms of profitability is modest with a median return on equity at 1% over the last five years, despite favourable refinancing conditions. We expect profitability to remain subdued due to low interest margins charged to customers and stable lending volumes, which provides only a limited buffer against adverse developments on the asset side. Net returns are typically retained which further strengthens capitalisation,” said Jakob Suwalski, a director in Scope’s sovereign and public sector team.

High concentrations on the regional economy and/or housing sectors increase the sensitivity of business portfolios to regional developments, while on-lending leads to concentration on the financial sector. However, the underlying loan portfolios of end customers are usually well-diversified across sectors and within the respective Land. The median share of non-performing exposure relative to gross customer loans was 1.2% in 2019.

“Despite the negative trends in asset quality as policy support is gradually withdrawn, we do not expect a significant deterioration of the sound asset quality of German Förderbanken in 2022 and 2023. The “house-bank” principle, where the credit risk of the ultimate borrower is assumed by commercial banks rather than the Förderbanken, helps mitigate risks associated with exposures to corporate and SME lending”, says Eiko Sievert, a director in Scope’s sovereign and public sector team.