Announcements

Drinks

German Länder: Strong H1 2022 fiscal outcomes to weaken given repercussions from war in Ukraine

By Julian Zimmermann, Senior Analyst, Sovereign and Public Sector Ratings

By Julian Zimmermann, Senior Analyst, Sovereign and Public Sector Ratings

The 16 German federal states, or Länder, collected a record level of tax in the first five months of 2022, with cumulative revenues growing to EUR 147bn by the end of May 2022, 15% higher than in the same period in 2021. Tax revenues had already recovered strongly last year by 12% YoY from a 3% decline in 2020 where the initial outbreak of Covid-19 caused nominal GDP in Germany to drop by 3.4%. Scope rates Bavaria, Berlin and Baden-Wuerttemberg at AAA/Stable, while the remaining Länder’s ratings are available on ScopeOne.

Importantly, tax revenues collected up until May 2022 also surpassed the EUR 124bn collected from January to May 2019, highlighting that the Länder’s most important revenue source, responsible for around 70% of total revenues, has recovered from the pandemic shock. Tax revenues have also significantly outperformed estimates by the government’s Working Party on Tax Revenue.

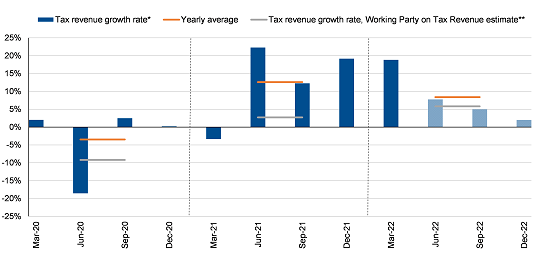

For 2022, we estimate tax revenue for the Länder at around EUR 380bn (+8% YoY), while official estimates project a level of EUR 375bn (Figure 1). This would represent an increase above the assumed trend before the pandemic when tax revenue in 2022 was estimated at EUR 357bn according to estimates of October 2019. Official tax projections made during 2020/21 amid the uncertainty caused by the pandemic have proven conservative, with tax growth rate estimates being around 7-10pps lower than actual outcomes.

A broad recovery in tax collection – VAT, personal income tax supported by short-time work schemes – led to the recovery in the Länder’s revenue despite a relatively sluggish economic recovery. Germany’s GDP rose just 0.2% YoY in Q1 this year after 2.9% growth in 2021. Higher corporate tax receipts, shifted from 2020 to 2021 to protect corporate liquidity during the pandemic, also helped. For 2022, inflation, averaging 6.7% January to June, is contributing to growth in nominal tax revenue: VAT, for example, is levied on the nominal sales value of products and services.

However, the German economy is facing a slowdown related to the consequences of Russia’s war in Ukraine. We have revised down our real GDP growth forecast to 2% for this year and next. We therefore also expect growth in tax revenue collection to slow in the second half of this year.

Figure 1: Change in quarterly tax revenue for the Länder

%-change, YoY

* Data is available until end of May 2022. For June 2022 and Q3 2022, assumed a 5% YoY growth rate, for Q4 2022 assumed a 2% YoY growth rate.

** Derived from tax revenue estimates from the Working Party on Tax Revenue May projections for the respective year.

Source: Destatis, Federal Ministry of Finance, Scope Ratings.

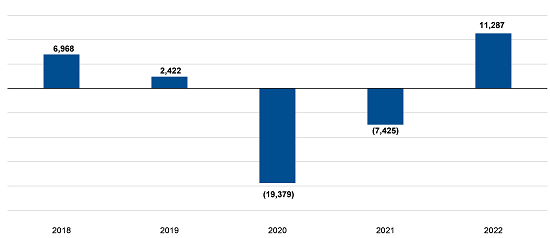

Still, the accounts of the Länder have already swung back to an aggregate fiscal surplus of EUR 11.3bn in the five months to end-May after recording deficits in the same period in 2020/21. Accordingly, Länder governments have been noticeably less active on capital markets than in 2020/21. Gross issuance YTD to end-June amounted to just EUR 19bn, after EUR 65bn in 2021 and EUR 126bn in 2020. We expect that the remaining liquidity from funding under Covid-19 related credit authorisations, together with the normalising interest rate environment, will likely keep funding volumes at around 50-60bn in 2022/23, broadly in line with 2019.

Figure 2: Länder budgetary balance

EUR bn, cumulative YTD at end-May

Source: Federal Ministry of Finance, Scope Ratings.

Budgets are likely to become more stretched in the second half of 2022 and into 2023, as tax revenue growth is expected to slow down. Länder budgets face high spending needs as prices rise for electricity, heating and investment projects. Aggregate expenditure amounted to EUR 189bn YTD in May, despite the absence of some pandemic-related spending that had led to spikes in expenditure in 2020 and 2021. To comply with debt brake provisions which prohibit any structural deficit over the coming years, Länder governments will have to strictly manage expenditure and investment levels.

Finally, the war in Ukraine has led to an influx of refugees into Germany, at around 870,000 up to 19 June, which led to some further expenditure increases for the Länder, even though the federal government has extended direct financial support for integrating and housing refugees. For these reasons, we expect the Länder’s fiscal accounts to close the year broadly in balance.

Amid the dual shock of Covid-19 and the Russian invasion of Ukraine, we view the exceptionally strong institutional framework in Germany as a continued rating anchor and support for the German Länder, linking the Länder’s creditworthiness closely to the federal government’s AAA-ratings.