Announcements

Drinks

Bank Capital Quarterly: Ensuring the resilience of banks to support the economy

The ECB has proposed to redefine ‘distributable items’ so only profitable banks or banks with positive retained earnings can pay AT1 coupons; and to increase the loss absorption and permanence of AT1 by removing obsolete triggers or limiting calls such that securities can only be replaced with CET1 instruments or cheaper AT1s.

“It remains to be seen how feasible these changes would be given the regulatory process and the way the AT1 market currently functions,” said Pauline Lambert, executive director in Scope’s bank ratings team.

On buffer usability, the proposal most likely to be implemented is to maintain a positive countercyclical buffer (CCyB) rate in a standard risk environment. A growing number of regulators have adopted this stance, including the UK, the Netherlands and Sweden, with the neutral level being 2%. Other recommendations include a shorter transition period when increasing the CCyB rate and permitting multiple CCyB rate decisions in a quarter.

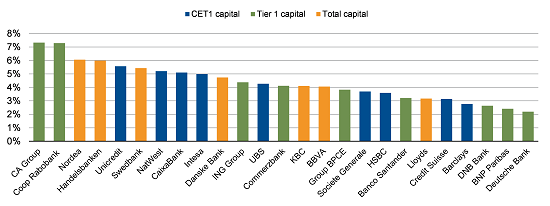

Lowest buffer to capital requirements (%)

Source: Banks, Scope Ratings

The ECB is also considering the merits of a fully or partially releasable capital conservation buffer as well as a core rate for the releasable systemic risk buffer. “Current use of the systemic risk buffer within the Single Supervisory Mechanism is limited but it could be used to cover additional risks such as those related to climate and financial innovation,” Lambert said.

By 1 January 2024, EU banks under the remit of the Single Resolution Board (SRB) must meet their full external and internal MREL targets including subordination. Intermediate binding targets have been in place since the beginning of this year, while European G-SIBs have also had to meet final TLAC requirements since the start of 2022. “Given the deadlines, we had expected banks to provide more clarity on where they stand against these requirements,” Lambert said, “but because disclosures vary greatly it is not always easy to reconcile the figures provided.”

Lambert added that major European banks appear to meet their MREL and TLAC requirements, as applicable. “But disclosures are not complete and are particularly patchy when it relates to non-risk-based MREL and subordination requirements. In our universe of 25 large European banks, less than half make disclosures regarding non-risk-based MREL and less than a third on non-risk based subordination MREL. We believe more complete disclosures would be helpful for market participants. We also find that the more final the requirements, the better the disclosures.”

In the EBA’s latest quantitative MREL report, 110 resolution groups had an external MREL combined shortfall of EUR 68bn against end-state MREL targets as of end-2020. Like restrictions on AT1 coupons when banks breach their combined buffer requirement, restrictions on the Maximum Distributable Amount related to MREL (M-MDA) can be imposed on banks that breach the CBR in addition to MREL and TLAC requirements. The M-MDA regime also applies to MREL subordination requirements. Payment restrictions, however, are not automatic.