Announcements

Drinks

Structured Finance Activity Report: Scope publishes new RMBS methodology

Over the past 12 months, we assigned new ratings to 107 instruments on 77 structured finance transactions across various structured finance asset classes. Approximately 39% of the issue volume was rated AAA, while 5% was rated sub-investment-grade. Newly-rated instruments over the past 12 months were mainly CRE/CMBS (27) and NPL (26).

In the 12 months to June 2022, we covered 352 structured finance instruments across 171 transactions; the major asset classes were NPLs (109 instruments) and CRE/CMBS (49). Total rated transaction volume since 2014 is in excess of EUR 216bn equivalent. Year-on-year rated new-issue volume growth, meanwhile, stood at approximately 20% in Q2 2022, with a total of EUR 3bn in rated new-issue volumes.

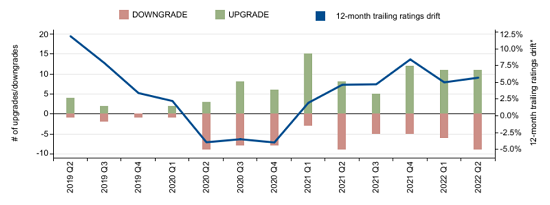

Scope downgraded 10% and upgraded 16% of 245 instruments monitored across 94 transactions in the 12 months to Q2 2022. NPLs accounted for 60% of downgrades, though their share fell to 18% of NPL monitored action from 40% in Q3 2021. Ratings drift has been positive since Q1 2021.

12-months trailing ratings drift*

*Scope’s 12-month trailing ratings drift is the ratio between (i) the number of upgrades minus the number of downgrades, and (ii) the total number of monitored ratings over the previous 12 months

The transaction of the quarter is Wolf Receivables Financing Plc, a GBP 315.4m gross-book-value securitisation of UK re-performing unsecured consumer debt. These internally highly-graded accounts were paying over the six-month period immediately before the cut-off date. The notes are backed by a granular portfolio of more than 356,000 accounts. We assigned a ASF rating to the senior notes issued by Wolf Receivables Financing Plc, while the junior notes were not rated.

Among other major achievements, we updated three rating methodologies (for CLOs, SME ABS and Counterparty Risk); and updated our rating definitions, clarifying our definition of default and long-term vs short-term correspondence table. We also published three research reports on NPLs and two on CMBS.