Announcements

Drinks

France: public spending pressures, divided legislature put medium-term fiscal consolidation at risk

.jpg) By Thomas Gillet, Associate Director, Sovereign and Public Sector Ratings

By Thomas Gillet, Associate Director, Sovereign and Public Sector Ratings

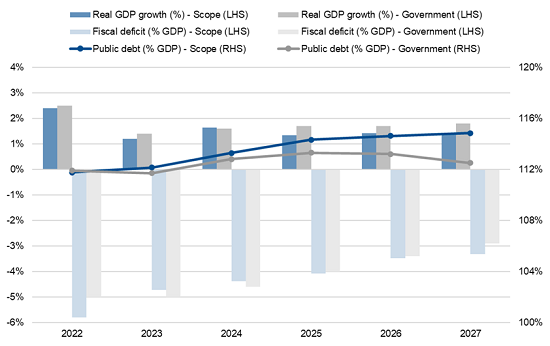

France (AA/Stable) is unlikely to meet its goals of reducing public debt in 2026 and lowering the fiscal deficit to below 3% of GDP in 2027 when President Emmanuel Macron’s second term in office is due to end. This reflects rising interest payments, the emergency government spending introduced in response to the worsening economic conditions linked to Russia’s war in Ukraine, and medium-term spending pressures.

Macron enjoys broad political support for the implementation of emergency measures to shield households and companies from the economic slowdown and rising inflation, and to accelerate investment in energy infrastructure and the military. However, political disagreement persists on his plan for reinvestment in France’s nuclear-energy sector and pension reform.

Moderate growth and sustained deficits pose challenge to debt reduction

Source: Ministry of Finance, Scope Ratings – Monitoring review of the French Republic as of July 22, 2022

With approval of the purchasing power package by the National Assembly on 22 July, Macron’s coalition known as “Ensemble” passed its first test having lost its absolute majority in legislative elections in June. However, the government will find it harder to put together a majority of deputies to back supply-side oriented measures supporting productivity and competitiveness. Even so, the ruling coalition could still find grounds for agreement with the centre-right party – Les Républicains – to contain public expenditure.

Measures in the purchasing power package include an increase of basic retirement and disability pensions by 4% from July 1, 2022 and a cap on increases in housing rent from the index level at 3.5% between July 2022 to June 2023. The law also creates a legal framework to restart temporarily a coal-fired power plant and allows a rise of caps on greenhouse gas emissions in case of “a threat to the security to the electricity supply”. The purchasing power package costs EUR 20bn (or about 1% of GDP).

The challenge for the government is that the room to offset some of this extra spending through tighter budgeting elsewhere looks narrow despite the introduction of an enhanced governance framework for public finances in December 2021 whose objective is to strengthen multiannual management and budgetary accountability. France has a weak record in fiscal consolidation over the past 40 years, running persistent budget deficits. Rising interest rates could further impede the government’s plan to start reducing public debt in 2026. The government’s interest burden is running at 1.2% of GDP and will rise to around 2.0% of GDP over the medium-term.

At the same time, longer-term investment is on the rise in response to Russia’s increased threat to European security. The government is taking back full ownership of Électricité de France SA at an estimated cost of EUR 10bn, with the utility central to France’s proposed EUR 50bn nuclear-energy investment plan. The government is also considering increasing the defence budget by 2030 beyond the current objective of EUR 50bn in 2025 – equivalent to about 2% of GDP – compared with EUR 36bn in 2019.