Announcements

Drinks

European house prices: rising divergence in growth across Europe

By Reber Acar, Associate Director, Covered Bonds

By Reber Acar, Associate Director, Covered Bonds

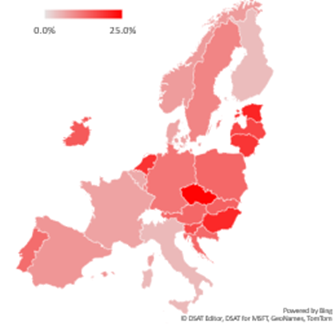

In Eastern Europe especially, prices are skyrocketing, with the Czech Republic leading the pack with a massive 24.7%, followed by Hungary and the Baltic countries. This compares to countries like Italy and Finland with more moderate rates of below 5%. We expect this development to continue in upcoming quarters as European housing markets will further fan out.

Annual increase in HPI as of Q1 2022

Source: Eurostat, Scope Ratings

Following the ECB’s first interest rate hike in more than a decade, monetary normalisation has finally reached the Euro Area. This will push mortgage rates up, cutting household affordabiltiy and dampening demand for house purchases. But house prices will be driven as much if not more by country-specific factors.

First, higher mortgage rates will not necessarily stop house prices from continuing to soar. The Czech Republic clearly demonstrates this. Czech mortgage rates stand at 4%, compared to a low of 2% in early 2021. Despite the doubling of mortgage rates, house prices have increased by more than 30%. The only thing that will cool the market will be further increases in rates combined with the Czech National Bank’s re-introduction of mortgage lending restictions, including limits on loan to values and debt-servicing capacity.

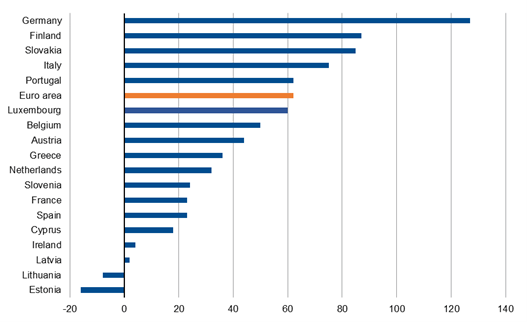

Second, the development of mortgage rates is far from being homogenous across the continent. The latest data from the ECB shows that household borrowing costs for house purchases increased by 62bp annually in the Euro Area, strongly driven by +130bp in Germany. In the Baltic countries, though, borrowing costs are still lower than they were last year. Yet we see the opposite picture when looking at inflation, which is around 20% compared to around 9% for the Euro Area. Debt that is still cheap combined with soaring inflation are the best ingredients to fuel the local house-price boom.

YoY increase in costs of borrowing for house purchases as of June 2022 (in bp)

Source: ECB, Scope Ratings

Third, housing is highly political, making government interventions more likely. This can be seen in Hungary, where the goverment massively subsidises the domestic mortgage market. After the central bank started to increase its base rate (now at 9.75%), the government froze mortgage rates at October 2021 levels. In addition, the central bank set up the ‘Funding for growth - Green Home programme’ in late-2021, which allows households to finance energy efficient houses at a maximum interest rate of 2.5%, representing more than 40% of current new mortgage loans.

In Germany, Kevin Kühnert, Secretary General of the Social Democratic Party, now wants to launch an initiative to help households raise equity for house purchases. This also has the potential to give house prices a further push.