Announcements

Drinks

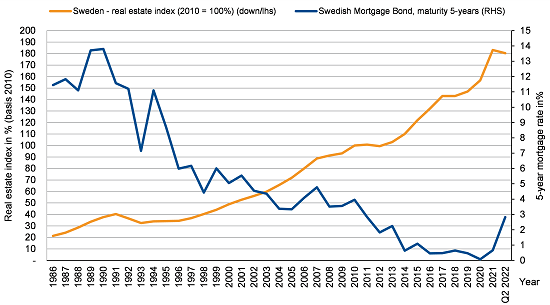

Swedish residential property correcting but mortgage market to remain resilient

“Downside risks stem mainly from high consumer price inflation which, combined with higher mortgage rates, may impair property values and dent the affordability of lower-income households with low savings capacity,” said Sebastian Dietzsch, a senior director in Scope’s structured finance team.

Swedish residential property price index vs. five-year mortgage rate

*Note: The values for Q2 2022 are forecasts

Source: SCB Statistics Sweden

“Significant property price inflation has helped to limit credit losses on Swedish mortgages because it has allowed more flexibility around refinancing and offered better headroom in restructuring or recovery scenarios,” Dietzsch continued. “Cases of default have been rare and have always been counterbalanced by sufficient levels of collateralisation.”

The strength of the Swedish economy, decreasing mortgage rates and moderate population growth had previously supported property prices as well as mortgage affordability. “House prices today are above the levels seen before the pandemic but they have fallen substantially from the peak,” Dietzsch said, adding that amortisation rules could further impair household income and stress affordability.

We do not expect material problems for the country’s mortgage market, even though residential property prices may see their first correction on an annual basis. The countrywide property price index has declined for the first time since 1993. Following exceptional growth in 2021, Q1 2022 yielded another 4.6% rise in the index but the market saw prices decline by about 5.8% in Q2, resulting in a year-to-date index decline of 1.5% in 2022.

Sweden’s regulatory mortgage lending framework enhances the safety net by capping household credit per income and increasing amortisation requirements depending on household leverage and property loan-to-value. This partially controls mortgage expansion. Analysis by the Swedish supervisor shows that an increase in mortgage rates to 7%, a level last seen in 1995, would lead to financial difficulty for only about 11% of mortgage loans originated in 2021.

Shared information-gathering about obligors’ credit quality and property values and a centralised foreclosure agency allow every lender to efficiently select the mortgage clients they want. Standardised data formats and sharing of data costs allow a highly automated time- and cost-efficient lending process for all mortgage originators in Sweden.

Download the full report here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.