Announcements

Drinks

France: Macron needs progress in uphill task of pension reform to stabilise debt, lift growth

By Thomas Gillet, Associate Director, and Thibault Vasse, Associate Director, Sovereign Ratings

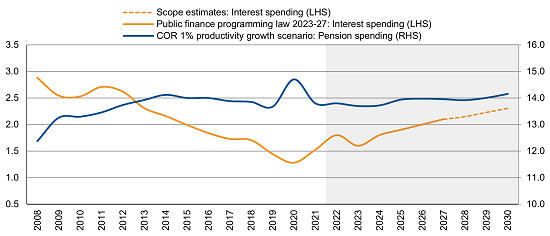

France (AA/stable) is facing medium-term pension spending pressures as made clear in the latest projections from a government advisory agency, the Conseil d’orientation des retraites (COR). They forecast that pension spending will rise to 14.2%-14.3% of GDP with annual deficits of 0.4%-0.6% of GDP by 2030, from 13.8% in 2021, assuming productivity growth of around 1%, in line with France’s historical performance (Figure 1).

Projections do not account for the current balancing mechanisms under which government transfers automatically cover the deficits of different pension schemes. These transfers represented 2% of GDP on average over 2017-2021.

To be sure, the pension system is not yet facing an unsustainable long-term increase in spending. The COR expects pension spending as a percentage of GDP to return to a declining trajectory longer term, except in its most adverse scenario.

However, leaving the pension system unchanged is no longer compatible with the government’s medium term fiscal targets, particularly with France’s public finances taking the strain on households and business from the pandemic and the rise in energy prices.

Figure 1. France’s pension expenditure and interest burden

Interest (LHS), pension (RHS), % GDP

Note: Pension spending projections are based on 1% productivity growth, the COR scenario that is most in line with historical productivity growth in France.

Source: Ministry of Finance, Conseil d’Orientation des Retraites, Scope Ratings

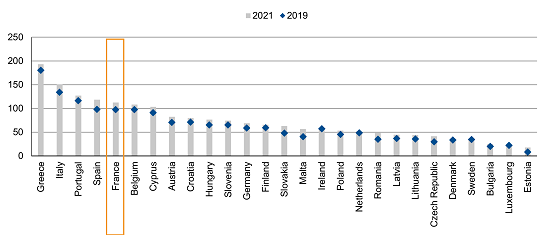

Changes to the pension system are critical to reduce the deficit to below 3% of GDP by 2027 and start reducing public debt by 2026. At 113% in 2021, public debt was among the highest in the EU (Figure 2).

Rising pension costs through 2030 coincide with increasing interest costs amid rising rates in Europe. The 10-year yield on French OAT’s rose to 2.67% on 26 September from 0.28% at year-end 2021. This will increase France’s interest burden that has remained contained so far despite the sharp increase in public debt during the Covid crisis.

Figure 2. Public debt-to-GDP in EU member states

% GDP

Source: European Commission, Scope Ratings

The ECB’s decision to hike rates by 75bps and embark on a policy normalisation path will push up France’s interest bill, though the effect will be gradual given an average debt maturity of more than eight years.

The Banque de France estimates that each percent point increase in yields could push up France’s interest burden by 1pp of GDP and debt by 5.5pps of GDP over 10 years. The burden could thus rise by up to 3pps of GDP over coming years based on latest baseline projections from the 2022-27 Stability Programme which foresees yields on 10-year bonds rising to 3.0% in 2027.

Pension reform could help tackle France’s budget rigidities and boost its flagging growth potential estimated between 1.0% and 1.4%. The COR estimates (based on the retirement age moving progressively from 62 to 64) that fiscal space will increase by around 2pps to 3pps of GDP by 2070 depending on different assumptions, notably those for annual productivity gains which range from 0.7% to 1.6%.

Pension reform remains highly sensitive politically

The catch is that such reform remains one of the most sensitive political issues in France. The government’s proposed amendment to a social security appropriation bill already faced pushback from opposition parties, trade unions and even some of the majority’s coalition partners.

We expect a less ambitious reform than Macron’s election pledge given the government’s lack of a parliament majority. The government could favour a gradual approach, potentially through a grandfather clause, to alleviate social tensions and introduce a reform by end-2023 with limited consultations.

Passing the pension bill is critical for the government’s credibility regarding other reforms, momentum for which was lost due to the pandemic, as we approach the six-month mark in President Emmanuel Macron’s five-year second term. But if the pension question frays the government’s relationships with coalition parties and social partners, progress on other policy issues may be hard to achieve in an increasingly challenging economic climate.

Brian Marly, Associate Analyst, and Raphaël Bigio, Intern Analyst, contributed to this commentary.