Announcements

Drinks

Europe’s ESG-linked corporate bond issuance to rebound; volumes steady at around 30% of total

ESG-related issuance in January was robust at around EUR 15bn but volume trails the amount issued a year ago – around EUR 21bn – before last February’s escalation of Russia’s war in Ukraine which contributed to the sharp drop-off in activity during the year. By contrast, issuance back in January 2021 was just EUR 8.3bn.

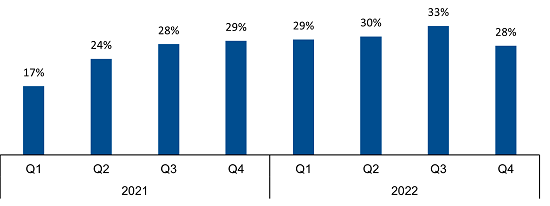

“ESG-linked securities accounted for 30% of all European non-financial corporate bond issuance in 2022 compared with only around 25% in 2021, an enlarged share of the market that is likely to hold steady this year,” says Eugenio Piliego, director at Scope Ratings.

“The proportion of ESG-linked bonds has stabilised over the past six quarters, in line with ESG-linked issuance in North America and Asia in 2022, after the rapid growth over several quarters to end-Q3 2021,” says Piliego.

Quarterly share of ESG corporate bonds issued in Europe during 2021/22

Source: Bloomberg, Scope Ratings

Corporate treasurers eager to tap demand for ESG-linked securities

Overall corporate bond issuance fell sharply last year amid inflation, rising interest rates and growing market and macroeconomic uncertainty, made worse by the war in Ukraine, but corporate treasurers proved relatively comfortable in issuing ESG-linked debt. They are likely to remain so, judging by the surge in corporate debt capital market activity this year.

European companies quick to market this year with ESG-linked deals include French utility Engie SA (EUR 2.75bn), the UK’s Thames Water Utilities Finance PLC (EUR 1.65bn), airline operator Air France-KLM SA (EUR 1bn) and power utilities E.ON SE, Energias de Portugal SA and Iberdrola Finanzas SA, each with EUR 1bn issues.

Leading issuers in 2022 included Italian utility Enel SpA (EUR 11bn), Dutch utility TenneT Holding (EUR 6.9bn), French water utility Suez SE (EUR 4.3bn), German property firm Vonovia AG (EUR 4.1m), and German auto maker Volkswagen AG (EUR 4bn).

“Among the different ESG-related bond segments, it was issuance of green bonds that picked up in 2022 in Europe and Asia after declining in the previous four years compared with other sustainability-linked securities, such as social bonds, transition bonds or bonds with embedded ESG-related covenants,” says Anne Grammatico, analyst at Scope.

“This can be partly explained by favourable policy making in several countries that provided an incentive for more corporate green bond deals, accounting for close to 60% of total ESG-related bonds in 2022,” says Grammatico. In absolute terms, green bonds declined only a little to EUR 80bn.