Announcements

Drinks

Spain: higher funding costs provide strong incentive to broaden public debt domestic investor base

.jpg) By Jakob Suwalski, Director, Sovereign Ratings

By Jakob Suwalski, Director, Sovereign Ratings

Spain (A-/Stable) is not under immediate pressure from rising borrowing costs and the ECB’s less accommodative monetary policy due to the improved profile of public debt and relatively robust economic outlook compared with the rest of the euro area.

Still, Spain’s government deficit is set to remain above 3% of GDP over the coming years, given higher public investment and current expenditure. The government spending ranges from large-scale infrastructure investment to diversifying the country’s energy sources and other industrial projects to rising healthcare and social costs related to the ageing population.

Spain’s net sovereign debt issuance in 2023 will be only slightly below last year’s EUR 70bn, though the decline contrasts with increases among with the euro area’s other big borrowers such as France (AA/Stable) and Italy (BBB+/Stable). The reduction of the ECB’s holdings of Spanish government securities as part of the asset purchase programme will amount to EUR 14-20bn this year and EUR 17-28bn in 2024 and again in 2025, representing what the private sector will have to fund in the medium term.

This raises questions about the optimal financing strategy for Spain in terms of instruments, maturities and, importantly, investors. It also matters for the Spanish regions as they depend largely on the central government for their funding, accounting for about 60% of the total sector’s debt. The gradual re-entry of Spanish regions into capital markets would enhance the diversification of public sector debt by adding more issuers, thereby reinforcing financial stability.

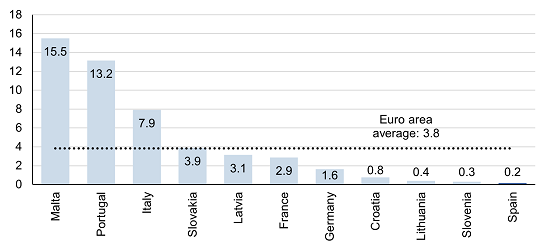

Figure 1 – Government debt held by the non-financial sectors

% total government debt, 2021

Source: ECB, Scope Ratings

Well diversified investor base, with upward potential among domestic private investors

The investor base of Spanish government debt of 113% of GDP in 2022 is well diversified, but the proportion of private investors holding Spanish government bonds will have to increase to gradually replace the ECB’s holdings (currently amounting to 32% of GDP) over time.

Attracting more foreign institutional investors is one option. Foreign appetite for Spanish public debt remains strong judging by their increased holdings of Spanish debt in recent years and a high level of participation in syndicated issues.

Another option is diversifying the types of security that the central government and Spain’s regions offer, such as green or other sustainability-linked securities. So too is tapping institutional domestic investors active in Spain’s large and deep domestic capital market. They hold 36% of government debt, compared with 52% in Italy, 33% in France and 32% in Germany.

However, the biggest opportunity may lie with individual domestic investors and non-financial corporations, whose current holdings of government debt is just 0.2% — tiny in of itself and compared with other EU members (Figure 1) – suggesting significant potential for diversifying refinancing risk and containing borrowing costs.

Tapping a broader range of domestic investors, encouraged by the higher remuneration on offer, especially in securities with short-term maturities would allow the Spanish government to improve the sustainability of government debt, the stability of financial markets, and reduce the linkages between government and domestic bank borrowing. The growing interest of individuals in Spanish sovereign debt is visible in their investment in recent Treasury bill auctions.

Low net wealth of Spanish households is an obstacle, but ESG-linked bonds could broaden investor base

The task is not without its challenges.

One reason for the small proportion of domestic retail investors invested in government debt is the relatively low net wealth of Spanish households and squeezed household incomes. Real household income per capita surpassed pre-pandemic levels in Q3 2022 in most OECD countries but not in Spain.

Tapping demand for ESG-linked debt may help offset this difficultly. Most of the region’s active in debt markets are making more use of opportunities in the ESG market. Green and especially sustainability bonds have become their preferred securities, substituting in large part traditional bonds, underpinning their pioneering role in the domestic market.

ESG-linked debt issuance tends to provide access to a wider and long-term oriented investor base, helping extend average debt maturity which can reduce annual funding needs.

Linking the proceeds of debt instruments issued by the public sector to specific objectives is proving popular especially with private savers.

Sign up here for a special Scope Ratings webinar on Wednesday, February 22nd for an expert discussion: Spain: public, regional, bank finance - assessing the outlook for 2023