Announcements

Drinks

Italian NPL securitisation review: performance to remain subdued in 2023

“Collection volumes have been flat in the last two years and were below our expectations in 2022. Servicers closed positions 10% below our B case expectations, the collections we compute at the B rating level; while the total time for notes to amortise continued increasing year on year,” said Rossella Ghidoni, a director in Scope’s structured finance team.

Compared to servicers’ forecasts, profitability on closed positions exceeded expectations in terms of discounted cash flows. The pace of net collections was mixed, lagging expectations in about half of the transactions.

“We expect that 2023 performance will be similar to 2022, with about half of the transactions lagging servicers’ projections by roughly 30% and the remainder outperforming servicers’ projections by an average of 70%,” said Paula Lichtensztein, a senior representative of Scope’s structure finance team. “Profitability wise, we expect that servicers will close positions above their own business-plan expectations for about 80-90% of transactions.

Scope NPL indices show decreasing trends

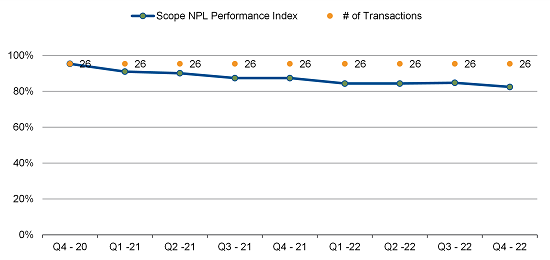

Scope’s proprietary NPL indices reflect the dynamic performance of Italian NPL transactions. The NPL Performance Index (NPI) has been declining since inception, although it has shown a moderate decrease of less than 10% in the last two years. It currently stands at 82% of servicers’ expectations. Since economic conditions remain weak and uncertain, we do not expect the NPI to revert in the short to medium term.

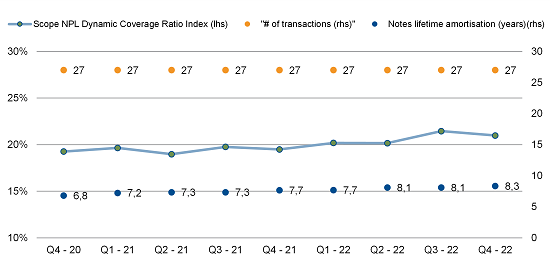

Scope’s NPL Dynamic Coverage Index (SCI) measures collections against the size of the outstanding notes, so it tracks the percentage of senior and mezzanine notes that are repaid annually. SCI is used to infer the total number of years needed for transactions to amortise. Year on year, the SCI shows a mild increasing trend i.e. a faster amortisation for rated notes, mainly driven by servicers’ lower recovery costs. Despite a marginal improvement in the speed of note amortisation in the last quarters of 2022, the total time for the notes to amortise has kept increasing year-on-year.

NPL Performance Index (NPI)

Source: Scope computations on servicers and payment reports.

Scope NPL Dynamic Coverage Index (SCI)

Source: Scope computations on servicers and payment reports.

Download the Italian NPL securitisation performance review here.

And join Rossella Ghidoni and Paula Lichtensztein from Scope’s structured finance team for a Webinar on Wednesday 7 June at 15:30 CET when they will they evaluate the performance of Italian NPL securitsations and lay out their expectations for 2023. Register here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.