Announcements

Drinks

Spain’s regional elections offer chance for economic, fiscal reform; political fragmentation a risk

By Jakob Suwalski and Giulia Branz, Sovereign & Public Sector Ratings

Regional governments determined by the 28 May parliamentary elections in 12 of Spain’s 17 autonomous regions* face delicate trade-offs as political parties prepare for national elections at the end of the year. Improving economic conditions and welfare provision will have to be set against limited fiscal space and need for fiscal reform.

Based on recent national polls, it is expected that political fragmentation will continue to be a significant challenge to governance during the upcoming parliamentary term. Although there have been some indications of a potential shift towards a two-party system, none of the two main traditional parties – the centre-right Partido Popular (PP) and the Socialist of the PSOE – is projected to secure sufficient seats to establish a majority government. This fragmentation is also evident at the regional level. The outcomes of regional elections will have implications for the ability of governments to effectively implement their policy agendas and collaborate with the central government on shared reforms.

Spain’s economy has proved surprisingly resilient in the face of the energy crisis, recording robust 5.5% growth last year, due primarily to a strong labour market, with sustained job creation and further reduction in the proportion of temporary employees in the private sector.

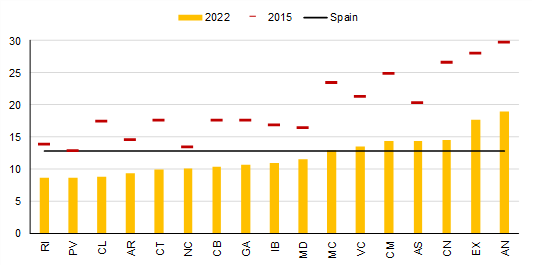

However, unemployment– running at 12.9% in 2022 – remains high by EU standards while growth in jobs and output uneven. Unemployment rates are well above the national average (Figure 1) in Andalusia and Extremadura and remain near 10% even in some more economically prosperous regions, requiring further efforts to support growth.

Figure 1. Unemployment rate, by region (%)

Note: AN = Andalusia, AR = Aragon, AS = Asturias, CB = Cantabria, CL = Castilla y Leon, CM = Castilla La Mancha, CN = Canary Islands, CT = Catalonia, EX = Extremadura, GA = Galicia, IB = Balearic Islands, MC = Murcia, MD = Madrid, NC = Navarra, PV = Basque Country, RI = La Rioja, VC = Valencia. Source: INE, Macrobond, Scope Ratings

Spanish regions face important budgetary constraints

The regions face significant fiscal constraints, which hinder policy adjustments and new investments. At end-2022, none of the regions was compliant with the 13% debt-to-GDP threshold in their fiscal framework while the aggregate fiscal deficit worsened to 1.1% of GDP from 0.1% in 2021, a contrast with the narrowing of the general government deficit to 4.8% of GDP from 6.9% in 2021.

Temporarily weak revenues were partly to blame given Spain’s fiscal equalisation system features a two-year tax settlement lag, thus reflecting the fall in tax income related to pandemic in 2020. However, regions have made few significant post-pandemic cost savings. Amid continued inflation, regions responsible for essential services will have to juggle voters’ pressure for better quality healthcare, education, social welfare with the need for cost containment.

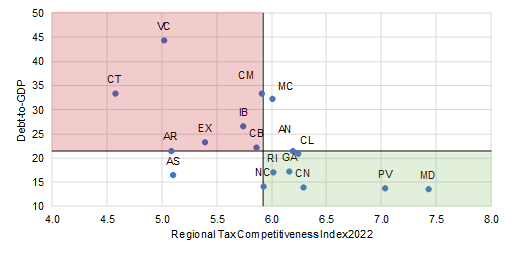

The trade-off between boosting economic growth and safeguarding government finances, without weakening public services, is most acute in regions with the least fiscal space as they tend to be those which need to improve their economic attractiveness. Valencia and Catalonia, the two least competitive regions according to the Regional Tax Competitiveness Index, are those with the highest debt (Figure 2).

Figure 2. Fiscal competitiveness and fiscal space

Index: from 0 (the weakest) to 10 (the strongest) (x-axis); % (y-axis)

Source: Bank of Spain, Indice Autonomico de Competitividad Fiscal 2022, Scope Ratings

Fiscal strengths, weaknesses vary across the regions

In this context, political consensus regarding prudent fiscal becomes more important, yet political fragmentation at the regional level has often interfered with fiscal management in recent years, often by preventing regional governments from adopting annual budgets, even at the price of preventing efficient spending of EU funds.

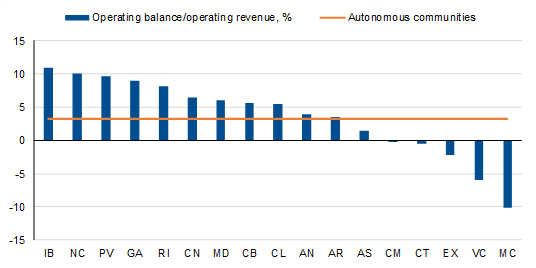

The nature of the fiscal challenge also varies across the regions. Some have robust operating margins, underpinning debt affordability and supporting investments. Others have structurally weak budgets, leaving them more heavily reliant on continued central government funding (Figure 3).

Such discrepancies reflect economic differences but mostly the resource redistribution mechanisms of the regional financing system in Spain. Apart from the so called “foral regions” of Navarra and Basque Country, the other regions receive most of their revenue through the equalisation system based on demographic, geographical, and historical cost criteria, leading to some distortions.

Figure 3. Budget performance disparities across regions

%, average ratios over a 5-year period (2018-22)

Source: Ministry of Finance, Scope Ratings

Elections offer slim opportunity for regional finance reform

The upcoming elections might bring opportunities to reform the system after 10 years of negotiations, but the greater risk is that the regional political landscape remains too fragmented for ruling parties to agree on change.

Improving regional finances remains essential to support fiscal consolidation at the general government level, hence the importance of Sunday’s elections. Effective collaboration between regional and central governments on the reform of the regional financing system and other common policy matters will shape political stability and fiscal policy in the country in the coming years.

Scope rates a number of Spanish regions on a subscription basis (see ScopeOne). Find more detailed analysis on the sector in our recent research report (publicly available): “Spanish Autonomous Communities – Sector Outlook 2023”.

* Spanish voters go to the polls on 28 May to elect members for 12 of Spain’s autonomous communities’ parliaments. The five regions not holding elections are Catalonia, Andalusia, Castilla y Leon, Galicia and the Basque Country.