Announcements

Drinks

Hungary’s temporary taxes take on permanent look, weighing down on investment, credit outlook

By Barna Gáspár, Director, Corporate Ratings

The Hungarian government has extended the “excess profit” tax regime to the end of 2024, along with maintaining other special taxes and other market intervention in selected sectors mostly characterised by a high degree of foreign ownership and the presence of large, listed companies.

The taxes have the heaviest implications for credit quality in the retail sector, helping ensure that some companies which became unprofitable last year will now remain so in 2023.

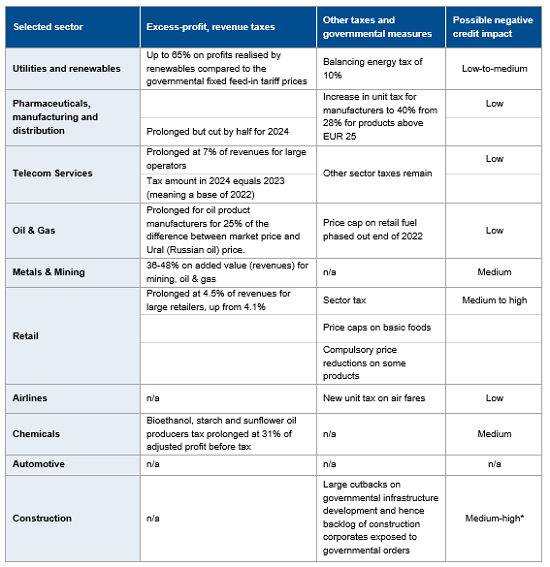

In the other sectors, the taxes will squeeze profitability without necessarily having severe credit implications. The extra levies are focused on companies with annual revenue of more than EUR 250m (see table below). Scope has ratings coverage of more than 75 issuers in Hungary, including several industries targeted by the windfall taxes: Alteo Nyrt (energy), Magyar Telekom Nyrt (telecom), MET Hungary Solar Park Kft (utilities), MOL Nyrt (oil & gas), Pannonia Bio Zrt (chemicals, bioethanol), Richter Gedeon Nyrt (pharmaceuticals).

In addition, the prolongation of the windfall taxes – originally set up to fund household energy subsidies but maintained despite falling energy prices – breaches commitments the government in Budapest had given to the European Commission. This further complicates efforts to end which has delayed disbursement of EU funds. The funds are vital for filling the order books of construction companies and encouraging infrastructure investment.

Policy uncertainty to weigh on investment climate

Such unpredictable fiscal policy discourages or delays investment by making it much harder to calculate likely future returns on capital and plan and design projects accordingly. This could cause delayed infrastructure upgrades in capital intensive sectors and shift some of the operations to other EU countries with a more predictable and tax environment and less government intervention. For example, German utility E.ON SE has said it might reconsider a EUR 1bn investment programme in Hungary if regulatory environment becomes unpredictable.

In the current market environment, new money is also expensive as the central bank has tightened monetary policy. Investors can keep spare cash on time deposits offering a quasi-risk-free return of more than 15%. This high return at low risk can be superior to returns companies expect from their normal business activities, deterring investment in new projects in Hungary.

More technically, the operational taxes have consequences for Hungarian corporate credit metrics. For accounting purposes, they are considered operating expenses. In other words, they have an impact on pretax profit or EBITDA, putting pressure on net debt/EBITDA multiples and EBITDA interest cover, not just cashflow metrics.

Multiple sectors targeted by extra taxes and market intervention

The immediate corporate credit implications of the sector taxes remain limited as they are mostly applicable in industries with typically high free cashflow – energy, telecoms, pharmaceuticals and pharmaceutical distribution.

However, the extra taxes vary from sector to sector. In the pharmaceutical sector, new taxes were introduced at the end of 2022 retroactively on the same year’s income, not conducive to improving investor confidence or helping corporate planning.

In the telecoms sector, the government has imposed new taxes on revenue and profit, albeit without significant credit implications. The Hungarian market is held by three large players with oligopolistic pricing power and offering limited customer choice. The operators aim to make up for increased operating expenses by raising consumer prices, up by 10-15% in Q1 2023 with future inflation-linked adjustments likely, and by reducing or delaying capex.

Retailing sector most vulnerable to extra taxation

Credit risk is more acute in retailing, which is typically a high-volume, low-margin activity where the tax on revenue has serious implications: it encourages sector consolidation (closure of small shops, makes room for M&A at large market participants at artificially induced low enterprise value), squeezes profitability and in many cases will deepen losses at the local operations of individual companies (Penny Market - REWE Group, SPAR, Auchan) in a business environment where retail volumes have shown double-digit year-on-year declines.

The government has also limited the room retailers have for manoeuvre by imposing price caps and compulsory price decreases on some products to combat yearly food inflation running at more than 40%.

Another sector facing a tax squeeze are airline passengers. A tax on air tickets has resulted in disputes between the government and carriers because it was done on a retroactive basis, with Ryanair PLC making the loudest protest and cancelling some routes, even though the impact on the airlines themselves is limited.

Hungary’s excess-profit tax regime also applies to the financial sector which finds itself required to pay taxes in 2024 based on profit earned in 2022, unrelated to market events of 2023. Savings accounts are also subject to an additional 13% levy from mid-2023 unless they are invested in domestic government bonds.

Table 1: Hungary’s windfall tax regime targets key sectors

Source: Hungarian tax decree, Scope Ratings

Note*: Indirect impact of tax extension