Announcements

Drinks

UK bank stress test provides some reassurance

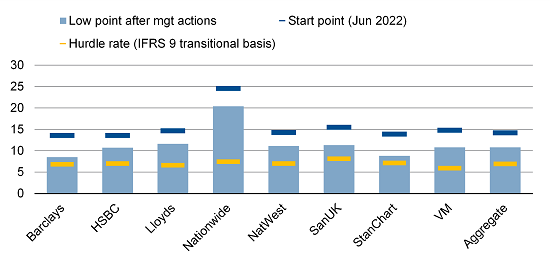

The CET1 and Tier 1 leverage ratios of the banks remained above their hurdle rates on an IFRS 9 transitional basis and none were required to strengthen their capital position.

“Improvements in asset quality as well as de-risking efforts in recent years have contributed to a more resilient performance by banks,” said Pauline Lambert, executive director in Scope’s financial institutions team and a lead analyst for UK banks. “However, that resilience was supported by reductions in dividends and variable remuneration and in some cases mandatory restrictions on AT1 coupons.”

All participating banks and building societies demonstrated resilience under the Bank of England’s 2022/2023 annual cyclical scenario stress test. While the assumptions for GDP, unemployment and asset prices were harsh, of a severity comparable to the global financial crisis, the UK bank rate only reaches a peak of 6% in the stress scenario. “This is less reassuring given the current rate of 5%,” Lambert said.

Banks remain above their CET1 hurdle rates in the stress test

Source: Bank of England

To maintain their solvency positions, most banks cut dividends and reduced variable remuneration. Mandatory restrictions on AT1 coupons also applied as some banks would have breached their combined capital buffer requirements. While the hurdle rates include applicable systemic buffers, they do not include the capital conservation or any countercyclical capital buffers.

“As it has consistently done, the Bank of England warned investors that banks would take such measures in times of stress. Unlike in some previous stress tests, no bank breached the 7% CET1 conversion trigger level on their AT1 securities.

“Over time, many banks have increased their resilience in the stress tests, with reduced capital drawdowns. In this year’s exercise, this was partly due to lower RWA inflation in the stressed scenario, with changes to regulatory requirements for internal credit models resulting in higher starting average risk weights for some banks. This is part of ongoing supervisory efforts to greater harmonise risk weights across banks,” Lambert said.

The resilience of mortgage portfolios is supportive for the asset quality of UK banks, which account for around 70% of total loans to UK households and businesses. These were not a driver of credit losses in the stress scenario. The aggregate cumulative five-year impairment rate for mortgages was a low 0.9%.

The average impairment rate on UK commercial real estate was 7.5%, below the impairment rate of nearly 9% on loans to other business sectors. CRE-related debt accounts for about 12% of UK GDP, but the exposure of UK banks has materially reduced to just over 30% from over 60% in 2008. Over the same period, the aggregate LTV of the major banks’ CRE lending has declined, with almost all bank-held CRE loans below 75% LTV as of mid-2022. The Bank of England noted that in aggregate, banks’ losses on UK and non-UK CRE exposures accounted for less than 7% of total impairments in the stress scenario.

Unsurprisingly, consumer credit accounts for the largest projected losses, with an aggregate cumulative impairment rate of 27%. However, for Barclays and Lloyds, the banks with the largest exposures, UK credit card and unsecured retail loans remain below pre-pandemic levels. Delinquency rates are also at or below pre-pandemic levels.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.