Announcements

Drinks

No let-up in pressure on European CRE companies’ credit quality

By Philipp Wass, Managing Director, Corporate Ratings

We see little let-up in pressure on European commercial real estate (CRE) even as interest rates approach the peak of the tightening cycle in Europe and the US, with base lending rates equal to or in line with prevailing yields of real estate companies, which averaged around 4%-6% at the end of 2022.

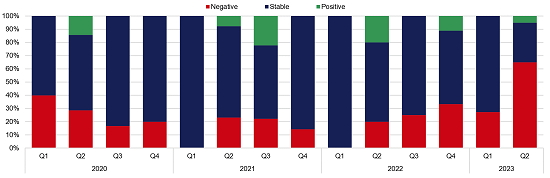

The downbeat outlook has led to a rising proportion of negative real estate corporate rating actions across the 34 firms we follow in the real estate sector. Actions have been concentrated in the Nordic countries and Germany. The drivers have been the sharp rise in borrowing costs, particularly in the Nordic countries, and widening capitalisation rates, felt most acutely in Germany.

Figure 1: Scope’s Rating actions: real estate corporates

Source: Scope Ratings

Like-for-like rental growth will not compensate in coming years, although this has accelerated in recent months either due to supply-demand imbalances or to CPI-linked leases. The market values of investment properties remain under constant pressure – most significantly for offices – as does CRE companies’ and homebuilders’ interest cover.

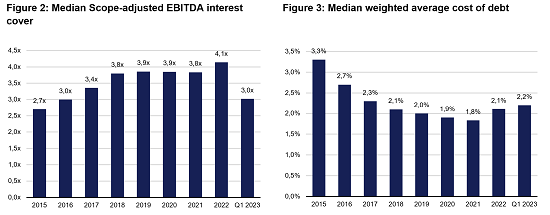

Median interest cover fell to 3x at the end of the first quarter for the real estate firms followed by Scope, from 4.1x at the end of 2022 (Figure 2). Interest cover across the CRE sector will continue to decline in 2023 as financing costs rise, though there are compensating factors.

Many CRE firms will report higher operating cashflows and are reducing interest-bearing debt through asset sales and are limiting capital expenditure. They are also focusing on secured borrowing with limited (20bp-50bp) margin increases to keep financing costs under control, while many benefit from favourable debt profiles (long average maturities) and interest rate hedges.

The sharp fall in interest cover for the companies in our rated universe was mainly driven by Nordic companies, which finance themselves via shorter maturities so are reliant on rolling over debt. They also have significantly higher unsecured exposure to floating rates. The same is true for homebuilders and developers, which rely on similar financing structures. The problem these participants have is the sharp fall in demand, which could pressure interest cover in coming months even further.

Rating downgrades and uncalled hybrid bonds (which have led to coupon resets) are another reason for higher financing costs, though this impacts only the cost of existing debt. Borrowing costs will rise more sharply for companies that need to raise additional debt or replace it with mezzanine financing. Banks will likely continue to refinance most existing customers but may not cover the entire funding gap. In addition to the rising cost of debt and falling property prices, limited visibility into future prices further restricts market-based refinancing options. The alternative could be dilutive equity issuance.

Sources: public information on peer group of 43 listed and unlisted real estate companies; Scope Ratings

If efforts to reduce debt levels through asset sales, reduced capex and lower shareholder remuneration prove unsuccessful or are only partially successful, CRE firms most exposed to the office market and/or secondary assets face the most pressure on credit ratings. For some companies, weak cashflows from yielding portfolios will not be enough to cover increased costs.

Retail: valuations bottoming out in premium segment

We expect investment markets to remain in limbo over the next few months. Investment activity will remain subdued until sponsors accept new margin profiles and long-term interest rates reach sustainable levels, while acknowledging a differing degree of adjustment in the market value of assets depending on the real estate sub-sector.

CRE companies that focus on retail properties can expect limited declines in market values through 2024 – down by up to 5% compared with year-end 2022. Changing consumer behaviour and market sentiment have led to a steady increase in capitalisation rates since 2017, when prime retail offered the lowest yields of any asset class.

Valuations now look sustainable, assuming only limited further monetary tightening. Rental cash flows are supported by a comparatively high proportion of CPI-linked leases, which should offset pressure for further modest expansion in capitalisation rates.

The exception is for retail-focused companies with a high proportion of second-tier or poorer quality properties. These companies could face to a double-digit decline in market values by the end of 2024. Rental income, still below pre-pandemic levels on average, will grow only slowly due to landlords' more limited ability to pass on cost increases through higher leases.

Operating costs will rise because of higher tenant turnover, contributing to more volatile and lower cashflow. Firms may lack the cashflow to cover the increased capex to ensure or restore the attractiveness of properties to tenants and customers.

Office: significant value correction ahead

Office property valuations will fall by up to 15% by the end of 2024 as the 95bp rise in prime yields to end-March 2023 from end-June 2022 implied a 27% decline in market values at constant rents. This is not yet fully reflected in portfolio valuations. The listed CRE firms we follow showed only a median 2% decline in market value in 2022.

We expect a trough in valuations later this year assuming a rapid transition of portfolio yields to higher capitalisation rates. However, distressed issuers' efforts to sell properties to refinance upcoming capital market debt or hand them over to secured lenders could lead to an even greater decline in valuations in the short to medium term even though distressed sales do not reflect fundamental market prices.

Owners of secondary and non-ESG compliant portfolios will face the more secular risk that buildings become obsolete in the medium to long term. Only CRE companies with deep pockets to convert office space to other uses where possible or repositioning properties to meet demand for greater flexibility and ESG compliance will be able to shore up property valuations which might otherwise fall by much more than 15%.

Industrial: rent growth, supply-demand support valuations

Higher rents and favourable supply-demand will limit declines in valuations of industrial property and underpin gains next year, partly because prices in this more liquid segment of the market have adjusted more quickly to rising interest rates. Demand for logistics-related property and data centres remains strong.

We expect price corrections to be limited to less than 10% by the end of 2024 even though yields increased by 113bp by end-March 2023 compared to the end of June 2022. Market values for new construction and/or recently built properties will rise again from 2024 assuming only limited further monetary tightening.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.