Announcements

Drinks

Credit Lines: German businesses face bumpy months ahead; energy concerns linger

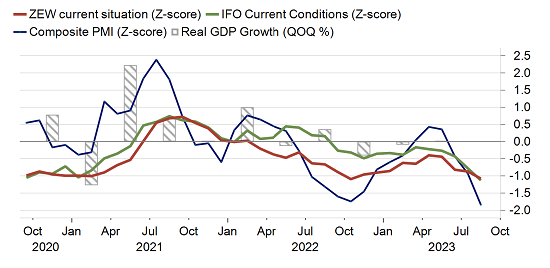

There are cyclical and structural reasons for the decline. The ECB has been raising interest rates sharply since 2022 and indications are that rates will remain high into 2024 even as inflation declines. This has cyclical effects on activity of the property sector and on household’s ability and willingness to spend. This was particularly visible in this week’s PMI survey that show a sharp fall of sentiment in the services sector in addition to the already depressed mood that has prevailed in the construction sector for more than a year.

Likewise, energy intensive production has yet to recover after the sharp spike in gas prices last year. Despite the normalisation in energy prices, output in chemicals, cement, glass, and paper has yet to recover from some of the lowest levels in recent history. This is partly due to companies’ reluctance roll their supply contracts and lock-in high prices last year, but also reflects concerns over the future path of gas and electricity prices.

German business sentiment deteriorates in Q3

Source: EUROSTAT, IFO, ZEW, S&P

While gas inventories are now 90% full ahead of the winter, the spike in European gas prices caused by a strike threat at an LNG facility as far away as Australia has underlined the ongoing energy vulnerability of German industry.

Europe still has not been able to fully replace Russian gas imports by other sources, which will be more volatile. To that, we can add the cost of the green transition that will go up in the coming years as the EU tightens its carbon taxation regime and reduces free allowances for energy intensive industries.

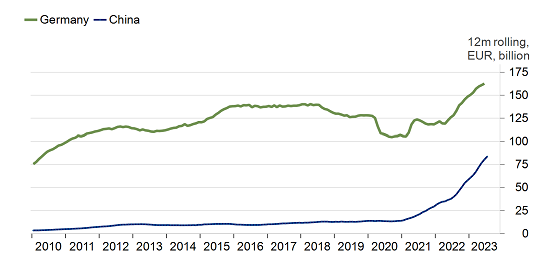

German Car exports hold their ground against rising Chinese competition

Source: DESTATIS, GAC

On the upside, there are positive trends in traditional manufacturing stalwarts where for example car production and exports are increasing after the supply shortages in 2022 are easing. A similar trend can be observed in other key sectors such as capital goods where exports are picking up despite the weak demand from key trading partners such as China. Thus, despite the morose mood, German industry appears to retain its competitive edge in these areas.

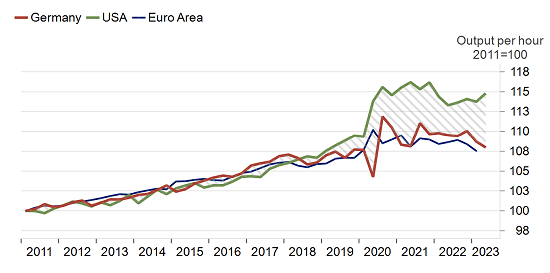

Germany’s productivity gap to the US has been widening since Covid

Source: EUROSTAT, BLS

However, there are long-standing and well documented concerns about the growth path of the economy that related to demographics and labour force growth. These have been accentuated by much slower productivity growth since Covid, where German labour productivity has lagged the US in particular while only maintaining a small lead to the euro area. Higher capital investment would be required to address this issue, but this is remains elusive given the mix of weak demand, high interest rates, and the prospect of high and volatile energy costs. German companies will eventually adjust to these challenges with innovation and investment as they have done in the past, but the immediate path will remain rocky.

Regarding the construction industry in Europe, the mixed German economic data points to the contrasting features of the credit outlook for companies in the sector, examined by Scope’s Rigel Patricia Scheller in research this week.

Order backlogs are healthy despite the uncertain economic environment, Rigel says.

In fact, the sector backlog averaged an unusually high nine months in Q2 2023. In contrast, higher rates and slow growth have set back demand for the construction of new commercial and residential buildings.

However, even where order books are strong, construction companies face a squeeze in profit margins from supply-chain bottlenecks and rising costs, so more of Europe’s large firms are seeking to expand their concessions business.

Concessions typically generate less cyclical cashflow and higher margins through fee-based infrastructure management such as highways and bridges. Concessions provided only around 20% of the revenue in 2022 of large companies in the sector, such as France’s Vinci SA and Eiffage SA, but more than 65% of EBITDA and operating profit respectively.

Companies such as Spain’s Ferrovial SA, ACS SA and Sacyr SA have their sights set on increasing the volume of their concessions business in the coming years. The three companies have sold assets worth EUR 7bn in the past two years, providing funds for acquisitions, including several in the US.

Ferrovial has invested in a EUR 9.5bn project to revamp passenger terminals at JFK Airport (New York) while ACS purchased 56.7% of the SH 288 toll road in Texas for EUR 1bn.

Read Rigel’s full report here.