Announcements

Drinks

France: annual spending review is credit positive but no substitute for in-depth reforms

By Thomas Gillet, Brian Marly, and Thibault Vasse, Sovereign and Public Sector

Legally binding, periodic reviews of annual spending under prime-ministerial supervision are now mandatory for all public administrations in France (AA/Negative). Assessing the quality of public spending is not new but conducting it on a more regular basis within the budgetary process can improve on successive governments’ uneven performance on fiscal consolidation. It is also a requirement for the disbursement of non-repayable financial support under the EU Recovery and Resilience Plan.

Greater oversight follows the reinforcement of the country’s fiscal framework in 2021 to strengthen multiannual budgetary management, transparency, and accountability. The reform also complements the review of ministerial spending limits for 2024 that targeted cuts of EUR 4.8bn, or about 1% of the total, as exceptional Covid- and energy-related measures end.

The government’s capacity to back spending reviews with more in-depth reforms of the welfare system is limited. Yet, this is where the biggest potential savings in public finances most likely lie, since France’s welfare system is structurally more generous and protective than in similarly rated countries.

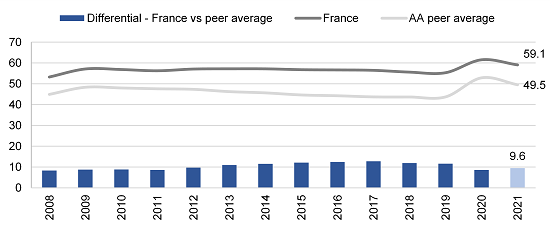

General government expenditure as a percentage of GDP exceeds by large margins that of other OECD member states. France’s spending is about 10 points of GDP higher than the average of AA publicly rated peers (Figure 1).

Figure 1. France’s public expenditure versus AA peer average*

% of GDP, points of GDP

*AA publicly rated peers as per Scope’s Core Variable Scorecard, i.e., Belgium (AA-/Stable), the United Kingdom (AA/Stable), and the United States (AA/Negative). Source: OECD, Eurostat, Scope Ratings

Social-protection savings to make fiscal targets more credible

President Emmanuel Macron’s ruling coalition lacks an absolute majority in parliament while reducing spending on social security, health and other welfare issues risks another round of socio-political unrest. This has flared up twice during his presidency, first with the “yellow jackets” protests, initially over a cut in fuel subsidies, and then this year’s strikes over pension reform.

True, the continuation of efforts to strengthen France’s fiscal framework could generate medium-term gains, which could be amplified by the reintroduction of EU fiscal rules in 2024. It could also help address one of the country’s main credit weaknesses: deviation from long-term targets for fiscal consolidation, which has undermined credibility of multi-year budgeting despite France’s long history of spending reviews.

Given the government’s commitment to lower the country’s tax burden and help households and business adapt to the energy transition, finding savings in France’s social welfare system could be crucial for reaching medium-term fiscal targets. This was highlighted by the recent reform of unemployment benefits and pensions.

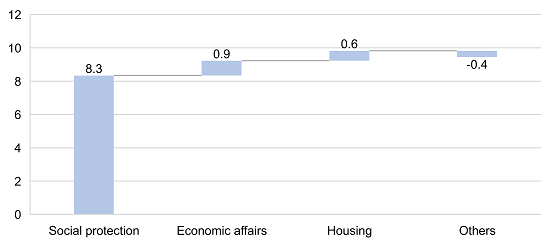

Should the government pursue reform of France’s welfare state, social spending is more likely to converge towards its AA-peer average over time. Currently, welfare expenditure explains the bulk of the difference in public spending with the average of France’s peers (Figure 2).

Figure 2. France’s public expenditure by function versus AA peer average*

Points of GDP, 2021

*AA publicly rated peers as per Scope’s Core Variable Scorecard, i.e., Belgium (AA-/Stable), the United Kingdom (AA/Stable), and the United States (AA/Negative). Figures may not add up due to rounding. Source: OECD, Eurostat, Scope Ratings

Further measures are crucial as the pension reform promises only modest fiscal gains. The latest projections from the Pensions Advisory Council point to persistent deficits of the pension system in the long run, despite the impact of this year's reform and government’s reasonably optimistic assumptions, including full employment by 2030.

Budget forecast relies on spending falling faster than revenues in terms of GDP

France’s annual spending review is thus critical to add credibility to government targets of reducing the fiscal deficit to 2.7% of GDP in 2027, from 4.7% of GDP in 2022, and public debt to 108.3% of GDP in 2027, from 111.6% of GDP in 2022.

The medium-term budget for 2023-2027, yet to be approved by parliament, envisaged a steady decline in public revenues as a share of GDP, from 53.4% in 2022 to 51.4% in 2027, alongside a decrease in expenditure, from 58.1% to 54.1% over the same period, despite growing investment needs for the green and digital transitions.

Weakening public finances and implementation risks to the reform agenda underpinned the Negative Outlook we assigned to France’s AA long-term ratings in May. Scope Ratings' next scheduled review date is on 10 November.