Announcements

Drinks

Commerzbank's updated strategy promises profitable future; implementation will be challenging

By Christian van Beek, Director, Financial Institutions

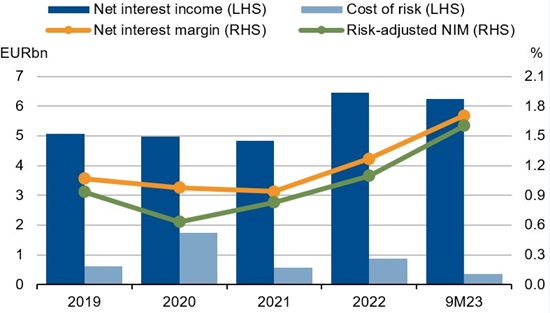

The risk of setback, while significant, should still be set against the bank’s better recent performance marked not just by improved net interest income as the interest-rate cycle has changed in European banks’ favour but also tight control of costs.

Figure 1: Interest income and cost of risk

Source: SNL, Scope Ratings

German bank can point to strong recent revenue, cost performance

Commerzbank has vigorously pursued its strategic realignment and efficiency improvement programme in recent years. In addition, the significantly improved cost-income ratio of just under 60% in the first nine months of 2023 is driven by a sharp increase in its net interest margin, which has been on an upward trend since the interest rate hikes in 2022.

Even if this development could not have been foreseen when the earnings targets were originally set, it is a harbinger of the fundamentally improved earnings potential of Commerzbank and German banks in general in the coming years.

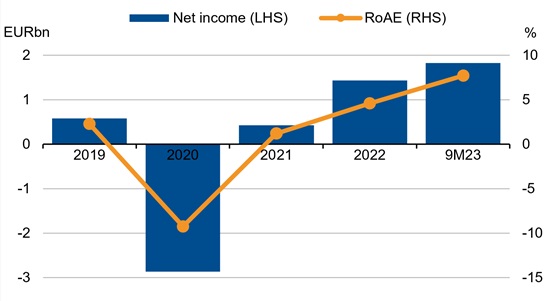

Figure 2: Commerzbank’s performance indicators

Source: SNL, Scope Ratings

Management counts on new ‘Moving Forward’ plan to maintain momentum

This favourable context is the background for Commerzbank’s recent announcement of an earlier-than-expected new three-year plan to 2027, as the bank considers it has largely achieved targets in its 'Strategy 2024'.

Under the new strategic plan, entitled 'Moving Forward', management is targeting a further improvement in profitability, with net profit of EUR 3.4bn, compared to EUR 1.4bn in 2022. This result would translate into a target return on tangible equity of 11.5%, raised from over 7.3% as part of the 2024 strategy and is based on further growth in interest and non-interest income. Commerzbank continues to focus on strict cost discipline, aiming for an improved cost-income ratio of 55%, lowered from the 60% objective for 2024. Although no further restructuring measures are planned, management envisages such measures if management misses that target.

Some assumptions behind strategy look optimistic

We are concerned that the projections are based on several optimistic assumptions:

First, there could be downside risks to the objectives if the assumed interest rate scenario does not materialise. For example, a further decline in inflation could lead to interest rate cuts with a corresponding negative impact on the net interest margin. In addition, we assume that competition for deposits in Germany will intensify further.

Secondly, the revenue targets are based on strong execution of the strategic initiatives in the Private and Small-Business Customers segment and in the Corporate Clients segment, which we consider to be very ambitious.

Thirdly, we believe that Commerzbank is facing increasingly fierce competition, especially in the German Mittelstand segment. Foreign banks have expanded their activities in Germany and are challenging Commerzbank's core businesses.

Finally, the near- to medium-term economic outlook in Germany, from levels of investment and to rates of non-performing loans, is cloudy, inevitably making the ‘Moving Forward’ more ambitious than the current ‘Strategy 2024’.

Commerzbank will need good results from digital, ESG-linked investment programme

Offsetting some of this uncertainty is Commerzbank’s tighter focus on the sustainability of its business model, with attention to ESG factors, and investment in IT. The bank plans to invest an average of EUR 530m a year, more than half on digital and the rest on regulatory requirements, infrastructure and corporate functions.

Such spending looks essential to keep pace with European competitors also focusing heavily on digitalisation.

Based on the increased earnings, the bank has set itself the target of a steady dividend growth. In principle, we consider a stable development to be likely. We also assume that under the new strategy the government is unlikely to divest its stake of around 15% by 2027 having so far set no time frame for such a move.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.