Announcements

Drinks

European CRE/CMBS outlook: stormy seas to continue

“We estimate 40% of fully-extended securitised loans present high or very high refinancing risks in 2024, on a par with last year’s performance, which saw slightly more securitised CRE loans defaulting or being modified at maturity than we expected at the start of the year,” said Florent Albert, head of Scope’s CRE loan and CMBS ratings team. “In addition, more than 69% of CRE loans in European CMBS fail to meet bank lenders’ current refinancing requirements. This puts even more pressure on borrowers to either fund the equity gap or to find refinancing solutions much earlier than anticipated.”

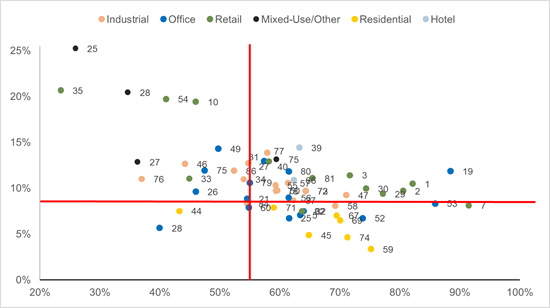

European securitised CRE loans: latest LTV and debt yield ratios

Data as of 31/12/2023. The numbers refer to loan IDs. See pp9 and 10 of the full report for details.

Sources: Scope Ratings CMBS tracker, Investor reports.

The fastest tightening of monetary and fiscal policies in recent history resulted in borrowing rates increasing by more than 370bp in Europe and capitalisation rates widening for the first time since the GFC. Consequently, negative leverage has reappeared and performance among sectors and within the capital structure is uneven.

BBB margins in 2023 were wider than H1 2022 Single B margins, while 2023 AAA coupons were higher than H1 2022 B coupons. Consequently, 40% of securitised CRE loans maturing in 2023 were extended beyond their legal maturity dates due to high LTVs and low asset liquidity despite strong debt yields.

Sector wise, Scope is positive on industrial and logistics, student housing and data centres; cautiously positive on hospitality and retail; neutral on multifamily and life sciences; and negative on offices. On the asset side, we expect capitalisation rates to remain stable if not go higher for certain asset classes as the CRE risk premium is expected to increase even if risk-free rates reduce.

“Only top properties benefiting from pricing power, in a regulated environment or where there is a supply and demand imbalance will experience real rental growth,” said Benjamin Bouchet, director in Scope’s structured finance team.

A number of new credit trends are emerging. First, term defaults are piling up in construction financing due to delays, higher than planned construction costs, and hard LTV covenant breaches owing to lower gross developed values.

Second, refinancing concerns are growing in the higher-for-longer interest-rate environment. Concerns are severe in markets with above-average debt leverage (such as Germany), and loans underwritten at peak valuations (2020-21) with high loan-to-values and maturing within the next two years (the UK) as well as assets exposed to structural change and obsolescence risk (non-prime office).

Third, while the “extend and pretend” strategy continues to play out, the increase in loan modifications highlights the lack of refinancing planning or exit strategies among borrowers. Traditional lenders and noteholders appear reluctant to accelerate distressed loans, leading to very few concessions to-date for these loan modifications and little visibility about the final loan principal repayments.

“We expect borrowers to continue exercising loan extension options in 2024 to benefit from advantageous locked-in financing conditions despite the higher costs of keeping interest-rate hedges in place. As a result, the refinancing wall of 2024 is expected to be a more manageable steeplechase,” Bouchet said. “However, the hurdles will not be easy to jump over for loans reaching their full extended maturities: 40% by count face high to very high refinancing risks.”

These loans present LTVs that are considered too high in the current lending environment, despite some solid debt yields, and/or which are financing Italian retail or European office assets.

Download the full report here.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.