Announcements

Drinks

Systemic risk remains high in European housing market

“Despite progress towards harmonisation across Europe, the differences in national mortgage markets are astonishing,” said Mathias Pleissner, deputy head of covered bonds. “We have identified countries we believe have a higher propensity to systemic risk arising from the characteristics of residential mortgage markets. Systemic risk factors highlight intrinsic weaknesses driven by the structure of a country’s mortgage market. Where a country’s mortgage market is exposed to high indebtedness and leverage as well as a combination of rate-sensitive loan origination and unsustainable house-price growth, they may have an exaggerated effect on that’s country’s society.”

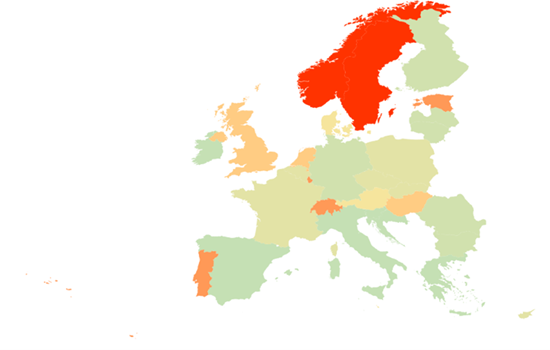

Mortgage market-driven systemic risk

Source: eurostat, Scope Rating

Assessing each mortgage market’s exposure to real estate encumbrance in general, Sweden, Netherlands and Norway come out as having high risk. Switzerland and Austria will be less systemically affected by mortgage turmoil as they have low owner-occupancy rates and below-average debt leverage.

Looking at household leverage by comparing average debt to income (DTI) to exposure to floating-rate mortgages, Norway and Sweden again stand out as having mortgage markets with the highest potential to be affected by systemic risk as affordability looks stretched. Denmark, Switzerland and the Netherlands also have high DTI ratios but their exposure to floating-rate mortgages is significantly smaller.

“Beyond rate rises, systemic risk affecting households is also driven by house price developments. Households are most exposed where house prices are overvalued,” Pleissner explained. “There is no simple way to assess a market’s degree of over-valuation, although for developed countries long-term house-price growth should not significantly exceed economic growth.”

On this measure, house-price growth in Austria, Norway and Luxembourg has been seven times average annual real GDP growth for over a decade. For Switzerland and Portugal, the multiple is five times; for France and Sweden four times.

“Across the three factors above, systemic risks overall are highest in the Nordic countries, which stand out in terms of household exposure to mortgage lending, borrower leverage, share of variable-rate loans and elevated house prices,” Pleissner added. Norway and Sweden rank first, followed by Switzerland, Luxembourg and Portugal. Above-average house-price corrections in recent years have relaxed the picture for Denmark, Finland and Germany.

Maintaining financial stability

Exuberance in European residential real estate has been a key theme in recent years. “Regulators have a well-stocked macroprudential toolkit in all the countries we identified as having high systemic risk, which is reassuring,” Pleissner said. “But measures are not evenly distributed and not all countries we believe are susceptible to corrections have implemented the same measures. A common thread is they only impact new origination. It will take time to insulate back books.”

Western European regulators have been late. German authorities have long chosen not to opt for targeted borrower-based measures but general bank-focused measures instead. This may change soon as plans are on the table for borrower-based, in particular income-based, measures as early as the first half of 2024.

“We strongly believe that well calibrated borrower-based measures are the most effective way to avoid exuberance in mortgage markets and are credit positive from a financial stability point of view,” Pleissner said. “Banks have voiced strong concerns about them, though, as they fear the impact on new mortgage lending and they are already burdened by the increase in the systemic risk buffer. But the German property market could be set for a revival so macroprudential measures might be well timed even if they only impact new lending.”

Download the full report here.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.