Announcements

Drinks

Italian NPL securitisation: negative ratings drift likely to abate but outlook subdued

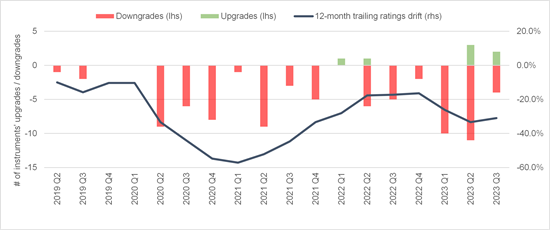

Scope currently rates 48 senior tranches and 18 mezzanine tranches across public Italian NPL transactions. Since Q2 2019, we have downgraded half the senior tranches and upgraded just six. “Downgrades have been driven mainly by significantly higher than expected haircuts on secured exposures while some transactions experienced slower than expected judicial resolution and/or higher than expected expenses,” said Antonio Casado, head of structured finance monitoring.

Downward ratings pressure has subsided, though. More recent vintages tend to exhibit a faster pace of collections than older vintages as well as increased levels of credit enhancement. The pace of collections has also been supported by more frequent use of discounted pay-off agreements (DPOs) and note sales recovery strategies.

Italian NPL ratings drift

Ratings drift is the ratio of difference of the aggregate rating upgrades and downgrades to the number of rated instruments

Source: Scope Ratings

Casado pointed out that while these strategies tend to be faster than judicial procedures they are often executed at bigger than average discounts, particularly note sales. “The pace of collections in early periods is also biased by cash-in-court and ad-interim collections, which typically provide a one-off boost shortly after closing. The rate of collections relative to portfolios’ original gross book value falls sharply a few periods after closing,” Casado said.

Over the years, recourse to note sales to support the flow of collections has often come at the expense of higher than average liquidation haircuts, due to weak market liquidity conditions. Better market liquidity could be reflected in better performance by Real Estate Owned Companies (ReoCos). These vehicles act exclusively in the interests of securitisation noteholders. Their sole purpose is to participate in property auctions and manage and dispose of the properties they buy. Their performance to-date has been disappointing, however.

Relative to the average rating we assigned to senior notes at closing for each servicer compared to current ratings, the average adjustment has been -2 notches while the average adjustment by servicer ranges from -5 to +2 notches. But there is no conclusive evidence that the range in transaction performance relates to servicers’ capabilities as it is difficult to assess their relative strengths as the portfolios they manage are not homogeneous.

Business plan revisions

Revisions to initial business plans are a key indicator of servicer performance. Almost all servicers have revised down their initial business plan projections. Revisions need to be interpreted with caution since initial projections are not always comparable across transactions and because some servicers make more optimistic assumptions than others.

To avoid rating biases, Scope stresses the importance of deriving cash flow projections that are independent but benchmarked against initial business plan estimates. As transactions season and the actual performance becomes available, we incorporate real operational experience in our updated cash flow projections and benchmark it with updates to business plans.

“Further downside adjustments to servicers’ business plans would be a strong warning signal. We expect that most servicers will continue to adjust down their business plans, as under-performance relative to initial projections is generally only recognised with a significant lag. But we will be especially vigilant around particularly large revisions in business plan expectations, and could penalise transactions if servicers’ revisions are not in our view credible,” Casado cautioned.

Real estate market dynamics have generally aligned with our expectations. Since we rated our first Italian NPL securitisation in 2017, residential prices in Italy have risen by about 10%, supported by an even bigger increase in the number of transactions. But despite moderately supportive real estate sector dynamics, NPL collateral has been liquidated at significantly bigger discounts than initially expected. We believe this is primarily due to the repercussions of the pandemic such as the change in interest-rate regime and the build-up of court backlogs.

“We will be watching to see if the trend of increasing discounts on asset sales since the outbreak of the pandemic stabilises. Moderating inflation and normalising monetary policy should have a positive impact over the medium term,” Casado said.

Download the Italian NPL securitisation outlook here.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.