Announcements

Drinks

EU’s revised fiscal rules would cut public investment

Download the full report here.

“The rules continue to focus on countries’ individual fiscal positions, with each country’s progress evaluated by growth in net primary expenditure. They remain incomplete as a truly European fiscal framework, which should also consider the creation of a permanent fiscal capacity to provide EU-wide public goods,” said Alvise Lennkh-Yunus, Head of Sovereign and Public Sector Ratings.

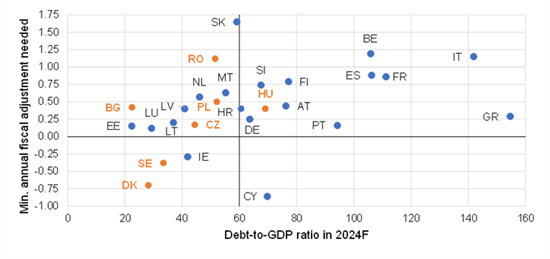

Significant fiscal adjustments needed to comply with EU’s revised fiscal rules

Source: Bruegel Institute estimates, Scope Ratings debt projections. Average annual fiscal adjustments over four-year consolidation plans

The fiscal rules remain highly complex but while there may be more flexibility this is unlikely to result in greater compliance, although continued eligibility for the ECB’s Transmission Protection Instrument could provide an important incentive.

“Overall, we expect EU member states’ fiscal consolidation paths to continue to be informed by investor and rating agency assessments of their credibility rather than relying solely on compliance with the EU’s revised fiscal rules,” Lennkh-Yunus said, adding that credible fiscal rules are an important institutional anchor and inform Scope’s sovereign rating decisions. “Our analysis considers fiscal policy credibility together with projected public-debt dynamics so complying with credible fiscal rules is credit positive,” he added.

The new rules only partially meet the objectives of creating a simple, flexible and credible framework that is better than the existing framework. On simplicity, replacing the “structural deficit” as a control variable with net primary expenditure is positive as it will reduce controversies around the unobservable “structural deficit” and the “output gap”.

As for flexibility, individual adjustment plans and their possible extension present uncertain outcomes. “While they may incentivise growth-enhancing reforms and investments, which support sovereign ratings, they also give member states enhanced flexibility to postpone and deviate from necessary fiscal adjustments, which may prove credit negative,” Lennkh-Yunus said. “Credibility and effective compliance are unlikely to improve and might even weaken.”

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.