Announcements

Drinks

Spanish banks quarterly: limited challenges in 2024 as profitability drivers remain supportive

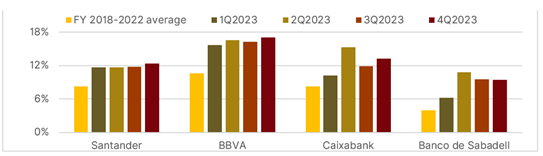

Return on equity for our sample of BBVA, Santander, Caixabank, Sabadell was 13% in 2023, above the 2018-2022 average. “In the absence of full guidance for 2024, we expect profitability to show signs of stabilising, albeit with ROEs remaining at double digits for most banks,” said Carola Saldias, lead analyst for Spanish banks. “Asset repricing following interest-rate hikes continued to be the largest contributor to net interest income, albeit at a slower pace as higher deposit costs have kicked in.”

Spanish banks’ RoE in 2023 beat historic levels

Source: Banks’ financial data, Scope Ratings

Deposits from households and corporates continued to grow in Q4, although these were mainly time deposits, implying a higher cost for banks, which detracts from profitability. The proportion of time deposits to total deposits has grown significantly for all banks and now represent 15%-35% compared with 6%-25% in 2022. On the plus side, the accelerated pass-through of policy rates to time deposits helped stabilise the deposit base: the stock of deposits for Spanish banks is finally returning to YE 2022 levels.

“All four banks in our sample reached their efficiency targets with better cost-to-income ratios. Most banks recently implemented restructuring measures that targeted further improvements in their cost structures, which are now starting to crystallise,” Saldias said. “We expect this trend to remain favourable for 2024 as revenues easily continue the banks to absorb costs.”

Cost of risk increased in Q4 vs Q3 for almost all banks but still remained below YE 2023 guidance. We expect cost of risk to trend closer to a normalised average across the cycle and that 2024 guidance will be slightly above that for 2023. The different dynamics are related to their business models, geographies and loan portfolio composition.

Household lending in Spain is expected to remain flat at least for the first half of 2024. Banks with a higher component of mortgage and retails lending should see a contained increase in cost of risk due to the effect of a smaller loan base. Commercial and SME loans should start growing again as both interest rates and high inflation show a downward trend, mostly from Q2 2024 onwards.

For BBVA and Santander, with 16% and 30% of consumer/retail and auto loans in their portfolios, we expect cost of risk guidance to remain the highest in the sample.

The extension of the windfall tax in January 2024 was approved on a temporary basis but it might become permanent pending further review. “We do not see the extension as material for banks’ bottom lines. In fact, a permanent tax would support our view that banks are increasingly to be seen as quasi-utilities, with regulatory and political considerations limiting their upside and downside risks. We see this as credit-positive even though it could limit growth and the sector’s competitiveness and ability to attract equity capital in the medium term,” Saldias noted.

A permanent, more stringent tax would hinder further consolidation in the Spanish banking sector, as internationally diversified banking groups would limit their exposure to countries where the tax burden is higher. “Smaller Spanish banks facing the challenge of reaching critical scale to improve efficiency could be more open to more consolidation to improve their competitiveness in terms of pricing and operational costs,” Saldias added.

Download the Spanish bank quarterly here.

Issuer rating reports available to ScopeOne subscribers:

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.