Announcements

Drinks

One year on: European banks in good shape

By Marco Troiano, Head of Financial Institutions Ratings

Despite fears of a vicious transmission effect in Europe in the immediate aftermath of the banking turmoil of spring 2023, the European sector weathered the immediate disorder and came through the ensuing market volatility without suffering any real fallout.

We always felt the fears expressed a year ago were over-stated and that longer-run sector themes would resume their place at the top of the sector narrative. Market volatility calmed relatively quickly and wholesale funding windows reopened following a short closure, including the AT1 asset class which had elicited some concerns after the write-down of CS hybrid instruments.

However, the episodes of a year ago serve as a useful reminder that uninsured large depositors remain flight-prone and that bank liquidity can evaporate rapidly when confidence wanes.

European banks maintained – and still do – capital buffers comfortably above regulatory requirements. Several domestic European regulators have increased countercyclical capital buffers or introduced new systemic risk buffers related to specific segments of loan books last year but European banks face the higher requirements from a sound position.

In fact, most banks have capital in excess of their own management targets and have committed to return excess capital via high dividend payouts and share buybacks. In our view, this reflects the lack of profitable growth opportunities in a heavily regulated, mature market.

The repayment of TLTRO drawdowns came and went without incident. Repayments did reduce Liquidity Coverage Ratios, as expected, but liquidity metrics also remain at a comfortable distance to regulatory requirements and continue to be strong.

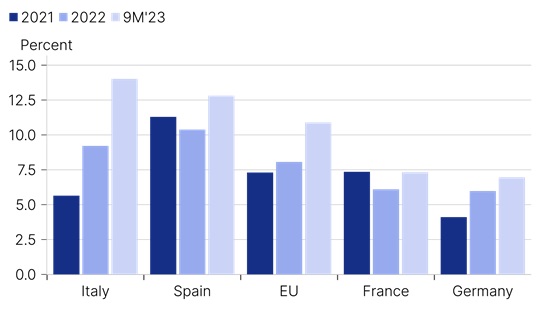

Higher interest rates have had a material beneficial impact on banks’ bottom lines, pushing up profitability and returns on equity in 2023 as net interest margins widened. Our sample of Spanish banks (BBVA, Santander, Caixabank, Sabadell) posted an average ROE of 13%, in 2023, above the 2018-2022 average. Our Italian bank sample (ISP, UCG, BPM, BMPS, BPER, Mediobanca, Credem, BPSondrio) reported an average ROE of 14.6% in 2023, almost double that of the previous year. However, not all banks benefited to the same extent. French banks margins have declined, at least temporarily. This reflects the faster repricing of regulated savings and limitations on the repricing of mortgages under French usury law.

Euro area banks: Return on average equity

Source: Macrobond, EBA, Scope Ratings

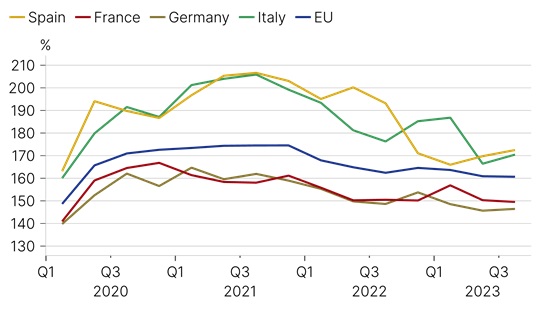

Euro area banks – Liquidity Coverage Ratios

Source: Macrobond, EBA, Scope Ratings

We do expect banks’ overall costs to rise this year. While the results of some cost-savings programmes have started to crystallise, some institutions also took advantage of better profitability to fund capex in areas such as IT. Overall, growth in costs will outpace growth in revenues in 2024 and 2025, driving a mild deterioration in profitability and efficiency ratios, albeit from very strong levels. But while peak profitability across the sector will likely have been reached in 2023, our expectation of higher for longer interest rates will continue to support banks’ bottom lines, albeit to a lesser extent.

The single most important driver of bank revenue and profit growth in 2023 was balance-sheet repricing following the end of the long period of low interest rates. This turned the rate environment from a sector headwind into a tailwind. Balance-sheet repricing, characterised by a rapid repricing of the assets side and a significant stickiness of deposits on the liabilities side, drastically changed the economics of retail and commercial banking, which sits at the core of most large and mid-sized European banks’ business models. The repricing phenomenon will likely reach its end-state this year.

As central banks rein in excess liquidity, greater competition for deposits will emerge. Higher rates have already drawn some customers to switch from sight deposits to more expensive time deposits, which will reduce interest margins and detract from profitability. We expect pressure on net interest margins to become more evident in the second half of this year, as base effects fade and quantitative tightening further drains excess liquidity from the system. We expect the median net interest margin to contract from 1.71% in 2023 to 1.63% in 2024 and to 1.52% in 2025, although it is worth noting that the 2024 number is higher than the 1.3% of 2022.

Given the higher rate environment and anaemic EU economic growth forecast for 2024, loan volumes will stagnate in the face of lacklustre demand. Under our base case, revenue growth will turn marginally negative in 2024 despite some offset from growth in non-interest income. The same market conditions will also see a moderate and gradual pick-up in asset-quality deterioration, although fears of a repeat of the post-global financial crisis rapid build-up of NPLs are misplaced. While we expect banks to post higher loan-loss provisions, these will be absorbed through operating profitability.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.