Announcements

Drinks

Italian banks: no acceleration in deposit repricing but funding pressure set to intensify

By Alessandro Boratti, Senior Analyst, Financial Institutions

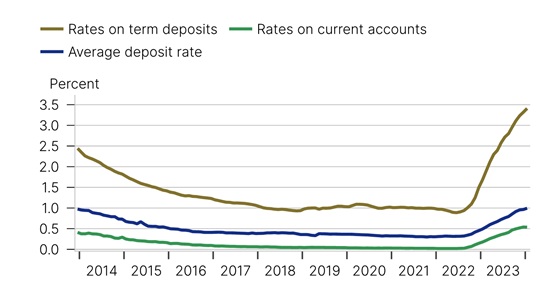

Italian banks’ deposit beta of 15.5% stands well below the euro area average, continuing the trend observed in 2023. Deposit attrition remains very low, however, and repricing is minimal. The average deposit rate was 1.0% in January, 4bp higher than in Q4 2023.

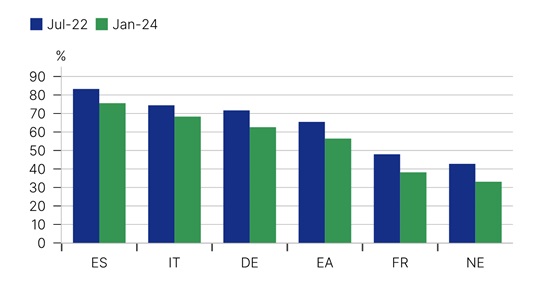

The slow repricing reflects two factors. First, subdued competition for customer funds due to the abundant liquidity still in the system and low funding pressure amid stagnant credit demand. This is particularly true for the largest commercial banks, which are mainly funded by cheap, sticky deposits. Second, in contrast to the euro area average, most Italian customer deposits are demand deposits, which are not typically remunerated. In countries such as France and the Netherlands, most customer funds are term deposits, which offer better yields.

Figure 1: Italian banks – Deposit rates by type

Source: Macrobond, Bank of Italy, Scope Ratings

Figure 2: Current accounts as % of total deposits

Source: Macrobond, ECB, Scope Ratings

Note: Total deposits comprise overnight deposits, deposits redeemable at notice, deposits with agreed maturities from households, firms, and other non-financial institutions.

Current developments are positive for Italian banks, which had expected faster repricing based on historical data. We see a different dynamic: funding pressures are set to intensify as Italian lenders repay the remaining EUR 140bn of TLTRO III, due by the end of the year. TLTRO outstandings are larger than the excess liquidity deposited at the ECB for several, mainly small, Italian banks, which means they will have to fund repayments via wholesale issuance, securitisation, or by reducing their balance sheets. In this context, we expect competition for customer deposits to intensify.

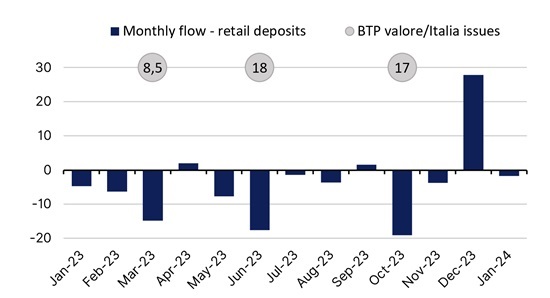

Banks continue to face competition from the Italian government, which over the past 12 months has issued over EUR 60bn of bonds aimed at retail investors. Retail BTPs (BTP Italia/Valore) are an established savings product in Italy and yield-savvy customers continue to shift their money to take advantage of better returns. As the ECB accelerates its quantitative tightening and gradually winds down its balance sheet, the Italian government is likely to increasingly target domestic households with retail placements.

The latest retail offering of six-year BTP Valore earlier in March raised over EUR 18bn from over 650,000 individual contracts, a record number in both cases. Retail BTP placements are negatively correlated with bank deposits: each large retail placement of government bonds coincided with a significant decline in retail deposits in 2023.

Figure 3: Italian retail deposits and retail BTP placements

EUR bn

Source: MEF, Bank of Italy, Scope Ratings

In January 2024, total system-level deposits (deposits from households, non-financial companies, general government and non-bank financial institutions) declined by approximately EUR 28bn and were 5% below the peak reached in July 2022 although they have been broadly stable over the past six months. We do not believe a gradual and controlled decline in deposits poses a systemic threat to the sector.

We remain constructive about Italian banks’ ability to maintain solid funding and liquidity positions in coming quarters. The sector’s financial fundamentals remain resilient, with double-digit ROE, clean balance sheets and capital ratios well above regulatory requirements. As of Q3 2023, the average liquidity coverage ratio stood at 170%, according to an EBA sample.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.