Announcements

Drinks

Almost 75% of CRE loans in European CMBS fail to meet bank refinancing requirements

“This means that almost 75% of CRE loans in European CMBS now fail to meet bank lenders’ refinancing requirements,” said Benjamin Bouchet, a director in Scope’s structured finance team, “putting more pressure on borrowers to either fund the equity gap or to find refinancing solutions much earlier than previously anticipated.

However, the refinancing of six industrial and logistics loans and the announcement of two CMBS (one secured against industrial assets and the other data centres) shows, in the case of the former, that appetite from lenders for industrial assets is resilient and, in the case of the latter, that there is demand for an emerging asset type that features strong and stable cash flows.

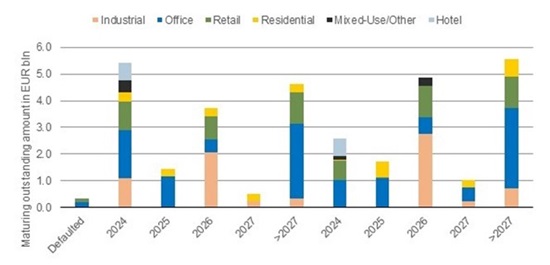

Six loans amounting to EUR 2.5bn equivalent were refinanced early in Q1 2024 including three due later this year (with low to no refinancing risk thanks to their strong metrics). All were secured by industrial and logistics properties. None have been refinanced through a new CMBS to-date but a new transaction secured against UK industrial assets was announced last week. “Combined with the continuous trend of borrowers exercising loan-extension options, this decreased the EUR 3.4bn 2024 refinancing wall to a more manageable EUR 2.6bn,” Bouchet said.

Scheduled vs fully extended maturity profile of European securitised CRE loans

Source: Investor reports, Score Ratings CMBS tracker

Nine loans have been extended beyond their initial fully-extended loan maturity in the last 12 months to give borrowers more time to find refinancing solutions. But financing conditions remain challenging as the higher-for-longer narrative is eclipsing rate-cut expectations.

The first post-GFC office loan secured in River Green Finance 2020 defaulted earlier this year. Another office transaction, Canary Wharf Finance II, showed a 13% decline in its property values in December 2023 from a year earlier, although the loan-to-value remains below 50% as a property was sold, deleveraging the transaction.

While refinancing risk for the Squaire transaction increased to high, refi risk for Phoenix decreased to moderate. Refi risk of all the ERNA S.R.L. loans increased to moderate despite very healthy loan metrics, following the borrower’s request for a two-year extension beyond their maturities. Less of a surprise, Pietra Nera Uno S.R.L.’s borrower is also seeking a three-year extension of all three loans.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.