Announcements

Drinks

Pfandbriefe investors shielded from volatile CRE valuations

By Mathias Pleissner, Deputy Head, Covered Bonds

Commercial real estate continues to deteriorate, the ECB noted in its latest Financial Stability Review, pointing to an 8.7% fall in annual prices to Q4 2023, and little to no improvement in transaction activity this year is making price discovery difficult. The outlook for offices is particularly bleak, the ECB noted. Risks are materialising as higher financing costs challenge the debt-servicing capacity of real estate firms and bank CRE NPLs are increasing, creating stress among the euro area’s most exposed banks.

For banks, covenant breaches likely explain most of the significant deterioration in the performance of real estate loans. While not all markets have experienced performance deterioration, Germany (+EUR 4bn) suffered the largest NPL increases of Q4 2023 driven by CRE exposure, which on average accounts for around 20% of total loans.

CRE loans typically bear refinancing risk because term amortisation is low. This makes reliance on values at a specific date material. Indeed, based on a sample of European commercial mortgage-backed securities, Scope found that almost three-quarters of all CRE loans fail to meet current bank refinancing requirements.

Volatile property values do not just matter at refinancing, they also matter during the term of a loan as financial and default covenants often rely on loan-to-value thresholds. In Germany, valuation volatility is particularly a problem for some of Germany’s specialist mortgage lenders and Landesbanken, which have large commercial real estate portfolios.

Pfandbrief investors protected

German Pfandbrief investors are protected from underlying price volatility, however. There is a 60% cap on loan amounts eligible for inclusion in cover pools, and lending values in Germany must be assessed using prudent, through-the-cycle valuation principles. Hence German Pfandbrief issuers cannot use the market value of properties as references for cover-pool eligibility.

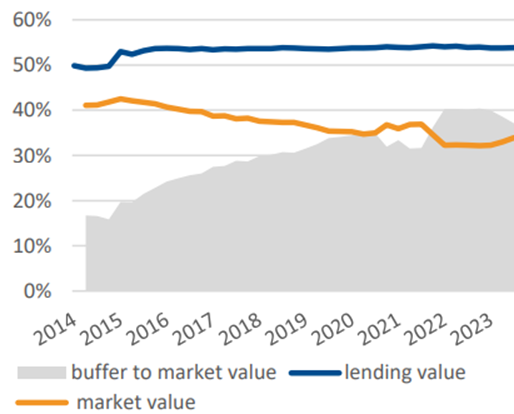

At the end of 2023, the average buffer to market values in German mortgage Pfandbriefe was nearly 40% compared to less than 20% a decade ago. This reflects the trajectory of market-value increases over the period. But because most other European covered bond laws are based fully on market values, a feature of German Pfandbriefe that was deemed to be a competitive disadvantage when prices rose and covered bond funding was constrained is likely to become an advantage today.

Loan-to-lending- vs loan-to-market value

Source: Scope, VDP

Regulators have taken valuation volatility into account through proposed Art. 229 (1) of the Capital Requirements Regulation (CRR III), which has introduced a “Property Value” derived from “prudent and conservative valuation criteria” that exclude expectations of price increases and adjustments to non-sustainable value components over the life of the loan.

Long-term sustainable valuations underlying German Pfandbriefe could be credit-positive if widely used as a basis for regulatory capital, legislative frameworks or even as a reference in underwriting criteria. So its utility can extend beyond the scope of Pfandbrief.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.