Announcements

Drinks

European corporate ESG bonds boom in H1 2024; FY issuance projected to rise 40%

By Eugenio Piliego and Anne Grammatico, Corporate Ratings

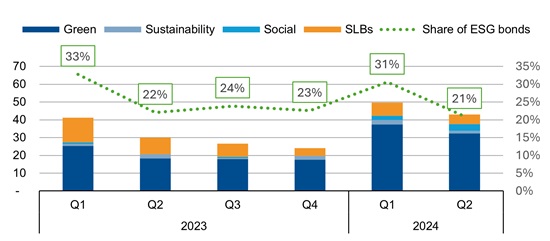

Our higher issuance expectations take into account the 30% y-o-y increase in H1 2024 and weaker volumes in the second half of 2023. Our projections are supported by the higher level of investment required in the context of the energy transition and the recovery in issuance from the real estate sector.

Figure 1: European corporate ESG bonds by type

EUR bn (LHS), ESG share of total bonds (RHS)

Source: Scope, Bloomberg

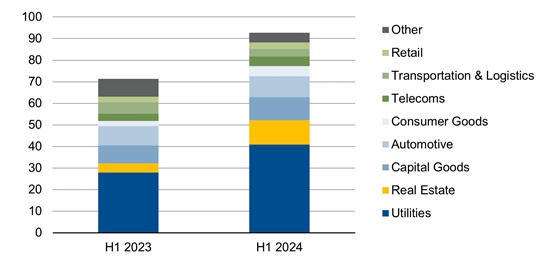

Figure 2: ESG bonds (EUR bn) by corporate sector: H1 2024 vs H1 2023

Source: Scope, Bloomberg

In discussions with several issuers in our coverage universe about their preference for ESG bonds versus standard bonds, the common message is that the key driver is reputation i.e. gaining credibility with their ESG efforts rather than pursuing better yields (greeniums), since the latter are not material.

When asked about their preference for green bonds compared to other ESG types, issuers said this was because green bonds are seen as the most credible by investors. French utility EDF said its green bond framework “is seen as a strong working tool which offers transparency to the market”.

Iberdrola, the Spanish utility, said the use-of-proceeds approach works very well for them because they have eligible assets to be financed directly; direct allocation and external verification offers full assurance and transparency; and the direct impact on sustainability is measured, externally verified and reported.

Green bonds, the company added, provide investors with a more precise return impact on their investments. But the step-up mechanism in the case of under-performance of ESG-related KPIs underlying sustainability-linked bond (SLB) frameworks provides a controversial incentive for investors to earn additional yield.

Most ESG bond issuers are companies with large portfolios of tangible assets. As such, their perspectives on green bonds may not necessarily apply to companies in transition or operating in other sectors, which are running asset-light business models.

Green bonds from European corporates increased by 60% in H1 2024 y-o-y. This is explained by growth in issuance by utilities (EUR 40bn in ESG bonds, up EUR 13bn y-o-y) and real estate companies (EUR 11bn, up EUR 7bn y-o-y), which have been heavy users of green bonds and made up around 55% of total ESG corporate bond activity in H1 2024.

Green bonds are also the preferred instrument in North America and Asia, although at just 5% of total bond issuance, both regions continue to materially lag Europe. SLB volumes declined 45% in the first half. This was not sector-related but driven by the perceived higher risk of greenwashing.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.