Announcements

Drinks

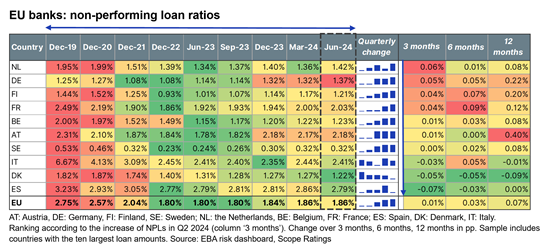

EU banks: NPL ratio stable in Q2 but modest asset-quality deterioration to persist

“We expect modest asset-quality deterioration to persist in coming quarters, driven by corporate sector weakness,” said Tatiana Fomenko, an analyst in Scope’s financial institutions team. “At the same time, a moderate recovery in global economic growth and a loosening monetary policy stance will likely cushion any deterioration, limiting downside risks to banks’ credit profiles.”

Quarterly increases in NPL ratios in the Netherlands, Germany, Finland and France were offset by declines in euro area peripheral countries. There were significant declines in Greece and Poland, although NPL ratios in those countries remain higher than the EU average.

Corporate NPLs accelerated in Germany and the Netherlands, while they showed signs of recovery in Spain. There was no generalised deterioration in NPL ratios across business sectors. NPLs in the real estate sector, the largest share of EU loan portfolios, trended marginally up from 2.6% to 2.7%. Construction remained stable at 6.3%.

In retail, the improvement in NPLs was mainly driven by Spain, although at 3.74% Spain’s household NPL ratio remains the highest among the major EU/EEA economies. Stage 2 loans at EU level improved marginally to 9.3% in Q2 (9.6% the end of 2023), reflecting positive developments in most countries. However, in Germany the ratio rose by 1.3pp to 12.8%.

“A slight improvement in the cost of risk at EU level reflects two key dynamics: small quarter-on-quarter increases in Italy and the Netherlands, and lower net risk provisions in Denmark, Germany, Spain and France. However German, French and Austrian cost of risk remains significantly above historical norms,” Fomenko said.

Download the full report here.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.