Announcements

Drinks

European Bank Capital Quarterly: Capital positions remain sound, requirements manageable

“Looking ahead, we expect the pace of capital generation to moderate as profitability declines and the driver of revenue growth shifts from margins to volume growth,” said Pauline Lambert, executive director in Scope’s financial institutions team. “At the same time, banks will be keen to maintain dividend payouts and deploy capital for strategic opportunities to strengthen their operations and boost revenues.”

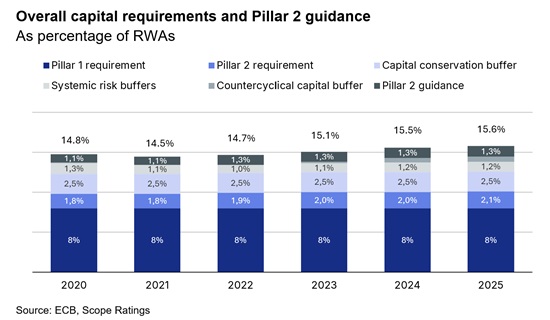

Capital requirements for 2025 are broadly stable compared to those for 2024. For EU banks, the average Pillar 2 requirement has increased slightly to 2.1% from 2% last year, while average Pillar 2 guidance is unchanged at 1.3%.

“Some banks continue to face add-ons for non-performing exposures (NPE) and leveraged finance,” Lambert continued. “Additional requirements may emerge for banks that fail to address persistent material deficiencies in risk data aggregation and reporting in a timely manner, as the ECB considers this to be a critical prerequisite for robust risk governance.”

The 2024 SREP cycle resulted in NPE P2R add-ons for 18 banks, down from 20 banks in the previous review cycle. For these institutions, the provisions for risks arising from older NPEs were assessed as being insufficient.

The ECB takes SREP outcomes into consideration when it sets its supervisory priorities. For the 2025-2027 period, supervisory priorities focus on three identified vulnerabilities:

The ECB takes SREP outcomes into consideration when it sets its supervisory priorities. For the 2025-2027 period, supervisory priorities focus on three identified vulnerabilities:

- Deficiencies in credit risk management frameworks and IT outsourcing and IT security/cyber risks to strengthen the ability of banks to withstand immediate macro-financial threats and severe geopolitical shocks.

- Addressing deficiencies in business strategies and risk management in a timely manner, with respect to climate-related and environmental risks as well as risk data aggregation and reporting (RDARR) capabilities, which remain key supervisory concerns.

- Stronger digitalisation strategies to tackle emerging challenges from the use of new technologies.

Meanwhile, final Basel 3 reforms have been in force in the EU since 1 January, although there is a lengthy transition period. The EBA’s latest monitoring exercise showed that banks will need only EUR 5.1bn in additional capital to be fully compliant by 2033. The capital shortfall is driven by G-SIIs, which account for nearly two thirds of the total.