Announcements

Drinks

Spanish banks quarterly: Competitive dynamics put margins under pressure

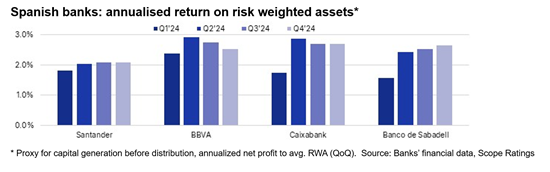

Net interest income for our sample of banks – BBVA, Santander, Banco de Sabadell and CaixaBank – grew by 8.4% in 2024 year over year, driven by the full repricing of loan portfolios as lending volumes continued growing while cost of deposits stabilised. The banks achieved an average return on risk weighted assets of 2.49% in Q4, stable compared to Q3 (2.5%), but below the Q2 peak of 2.56%.

“Interest margins and customer spreads fell for all banks in Q4. We expect this downward trend to continue, as competitive dynamics exert further pressure on growth in loan volumes in 2025,” said Carola Saldias, lead analyst for Spanish banks. “Fee and commission income increased in Q4 vs Q3 and year over year. We expect this positive trend to continue too, as economic growth in Spain and the recovery in loan volumes provide a larger customer base, hence a larger foundation for transaction fees.”

Asset quality will likely deteriorate, however, not just because of strong growth in retail lending but because commercial loans could suffer if export demand weakens following the imposition of US tariffs. “On the plus side for banks, funding costs are now stabilising as the shift from deposits to mutual funds has ended,” Saldias said. “Spanish banks had one of the lowest deposit betas of EU banks in 2022-2023, but the increase in deposit costs and wholesale funding has finally changed direction, giving the banks better visibility on their funding costs for 2025.”

Spanish banks maintain buffers above regulatory capital requirements but the banks are actively managing excess capital via shareholder remuneration, significant risk transfer and growth in risk-weighted assets. As a result, CET 1 ratios are tightly aligned with management targets. Final Basel III implementation is not expected to have any effects on banks’ capital metrics.

Download the Spanish bank quarterly here.

See also:

Scope affirms and publishes BBVA’s A+ issuer rating with Stable Outlook, December 2024

Scope affirms and publishes Banco Santander’s AA- issuer rating with Stable Outlook, December 2024

In addition, Scope has subscription ratings on the following Spanish banks. To view the ratings and rating reports on ScopeOne, Scope’s digital marketplace, or to register, please click on the following links: