Announcements

Drinks

Tariffs, EV transition, tighter margins test resilience in Europe’s auto sector

By Lucas Pozza, Corporate Ratings

Our view of the challenging crosswinds facing the sector remains unchanged. While most Europe-an OEMs benefit from conservatively managed balance sheets and ample liquidity – providing im-portant buffers against shocks in the short to medium term – management teams are grappling with a volatile operating environment and structural challenges.

Growing uncertainty surrounds US trade policy, whose volatility is disrupting supply chains in North America. Premium manufacturers such as BMW AG and Mercedes-Benz AG, which have a broader manufacturing footprint in the US, are relatively better positioned to absorb the tariffs shocks than those export-based OEMs, like Stellantis NV.

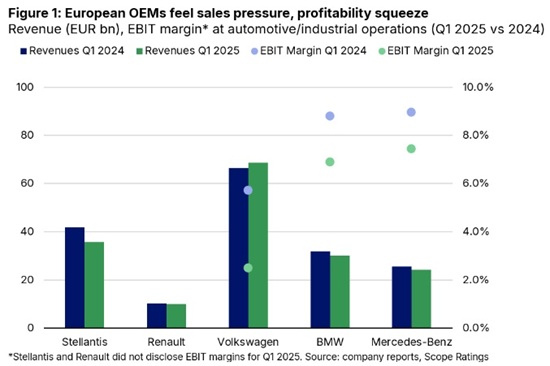

Profitability under pressure in Q1 as most OEMs report flat or declining revenues

Even if current tariff increases prove temporary, as recent US Supreme Court interventions sug-gest, the impact on the industry’s H1 2025 results is material. This volatility highlights the strategic importance of European OEMs’ ability to diversify – both market reach and the geographical spread of their industrial activities – which will become an increasingly important differentiating factor.

OEM management teams faced significant cashflow pressures stemming from multiple factors before the US tariff hikes. One of the most important challenges is how difficult the Chinese car market has become. Once a steady source of earnings notably for Germany’s OEMs. Intensifying competition in the increasingly EV-dominated Chinese market is eroding European OEMs’ local market share and profitability as electric and hybrid vehicles made by lower-cost Chinese com-petitors replace internal combustion engine (ICE) cars.

These pressures were clearly reflected in the OEMs’ Q1 results and guidance – or lack of it. Both Mercedes-Benz and Stellantis suspended previously announced 2025 outlooks.

The first quarter of 2025 reflected mounting profitability challenges across the European auto sec-tor, with revenue under pressure and profitability squeezed at both high-volume OEMs such as Volkswagen AG and Stellantis – the manufacturers with the biggest shares of the European market – and premium OEMs BMW AG and Mercedes-Benz.

For example, Stellantis, owner of the Chrysler and Jeep brands, felt the impact of higher US tariffs on its revenue and volumes in the US and soft demand in Europe as the owner of the Fiat, Opel and Peugeot Brands. At BMW, revenue growth in Europe and the US was offset by poor demand in China and the impact of higher tariffs on China-made EVs imported to the EU.

Growth in European EV sales amid lobbying efforts to relax regulations

Uneven sales growth in the EV segment – from hybrids to battery EVs – tariff-related uncertainty in the US market, and evolving EU regulations aimed at eliminating tail-pipe emissions remain central concerns for the European automotive industry.

The industry is increasingly focused on electrification, both to meet stringent EU emission targets and to lobby for softening those requirements.

Proposals under discussion include extending the EV-only deadline for new cars or easing rules for smaller cars, a segment where European OEMs have a competitive edge, especially Renault and some Stellantis’s brands such as Citroën and Fiat. Currently, EVs account for about 15% of the Eu-ropean market, well below the level needed to achieve current EU CO2 emission targets.

The European OEMs’ EV sales were mixed across brands and regions during Q1. Renault and VW recorded growth in Europe – where EV-specialist Tesla Inc. has been losing market share – but VW’s EV sales continued to decline in China. In the US, Stellantis’ EV sales fell. VW’s and BMW’s rose.

Results at VW showed the cost of its EV push. One in every five cars sold in Europe was fully elec-tric, but overall operating profitability shrank to 4.7% from 6% in Q1 last year, after adjustments for one-off non-cash provisions.

Batteries are becoming cheaper, but OEMs are focusing more on in-house battery development or creating JVs with strategic partners to further reduce costs.

OEMs grappling with US trade uncertainty

Rising US tariffs are prompting urgent industry responses to manage disruptions to supply chains and safeguard margins. Several OEMs are relocating some manufacturing operations to the US. Mercedes-Benz, for example plans to move production of its GLC sport-utility vehicle to the US, as does Stellantis with some Jeep models. However, such moves require significant investment in existing facilities, which many OEMs may not consider economically justifiable in the short term.

The largest impact of the new US tariff regime on OEMs falls largely on companies heavily reliant on vehicle and equipment exports from Canada, Mexico and Europe to the US due to limited local production capacity, like Stellantis or VW’s sports-car unit Porsche AG. OEMs from round the world have made significant investments in Mexico which currently is the largest exporter of vehicles to the US with over 2.9 million cars shipped annually.

Companies like BMW, Mercedes-Benz and Volkswagen’s namesake brand have factories in the US, providing some room to absorb the impact of higher tariffs.

Recent trade deals – such as the recent US-UK agreement – may ease the pressure on the indus-try and path the way to a broader agreement between US and EU. However, US import tariffs are set to remain higher than they were before Donald Trump returned to the White House.

European OEMs’ Q2 results to reflect tariff, market pressures; underlying strength remains

After a difficult Q1, the European OEMs’ Q2 results are unlikely to be much better given tariff un-certainty, the costs of the EV transition and weaker Chinese demand amid increasing competition. These headwinds are likely to weigh on earnings and cash flows through H1 if not all of 2025.

We expect sector Scope-adjusted EBITDA margins to fluctuate between 4% and 12% range until 2027, reflecting the mixed performance across the industry. At the lower end will be Stellantis, with only a 4% margin due large exposure to the US market and limited local production capacity. At the upper end is VW, with profitability supported by its diversification by product and region. Mercedes-Benz, a premium OEM with a large footprint in the US, will likely record a margin of around 8%-10% in the medium term, down from the 15% in recent years.

Longer term, the underlying strength of the European OEMs balance sheets remains a good plat-form for adapting to change and absorb shocks. This is particularly true for manufacturers with integrated captive finance arms (Mercedes, BMW, VW) which enhance internal liquidity and cash generation. Mass-market focused OEMs (Renault and Stellantis), more reliant in JVs with third parties, only indirectly benefit from dividend flow and shared operating costs.

We forecast that in 2025-2027 period the European OEMs will maintain their net cash position and ample liquidity reserves (>200%) despite the current challenges. Furthermore, European OEMs will continue to generate free operating cash flow in the medium term due to disciplined working capital and capex management coupled with prudent dividend policies.