Announcements

Drinks

Structured Finance Activity Report: positive ratings drift continues

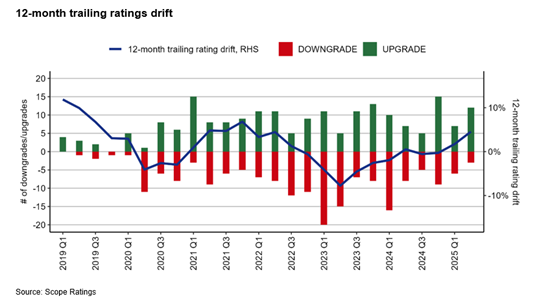

Of the 353 monitoring reviews conducted in the 12-month period across 151 outstanding transactions, 11% led to rating upgrades, 6.5% to downgrades.

Scope assigned new ratings or ancillary services to 87 instruments on 48 structured finance transactions in the 12-month period to the end of Q2 2025, raising new-issue volume by 12.4% year-over-year. A total of 60.2% of the new-issue volume over this period was rated AAA.

RMBS transactions experienced several upgrades, primarily attributable to the implementation of the RMBS Rating Methodology, alongside sustained performance. Ratings for SME and CLO transactions were largely unchanged, reflecting consistent credit profiles. Consumer and Auto ABS ratings saw several upgrades driven by strong collateral performance and accelerated deleveraging.

In the NPL sector, approximately 70% of ratings remained unaffected, indicating a period of relative stabilisation. However, rating activity in this segment continues to face challenges such as weak profitability and sluggish deleveraging dynamics.

Overall, Scope’s structured finance team covered 367 instruments across 189 transactions in the 12-month period. The major asset classes were NPL (87 instruments), Other (mainly CLN & Repackaged-debt and Reverse Mortgages, 78), and SME (44). By the end of the period, Scope had assigned ratings or ancillary services to over EUR 350bn-equivalent in structured finance instruments since 2014.