Announcements

Drinks

Italy’s banking consolidation wave set to continue

Banco BPM has returned to the centre of consolidation talk after UniCredit’s failed bid. But with MPS and BPER concluding their respective bids, options have narrowed. Against this backdrop, Crédit Agricole Italia (CA Italia) has emerged as a potential partner.

The French banking group considers Italy to be its second domestic market and an area for growth. CA already has long-term insurance and consumer credit partnerships with Banco BPM, recently increased its equity stake from 9.2% to 19.8%, and filed a request with the ECB in July to increase its holding to over 20%.

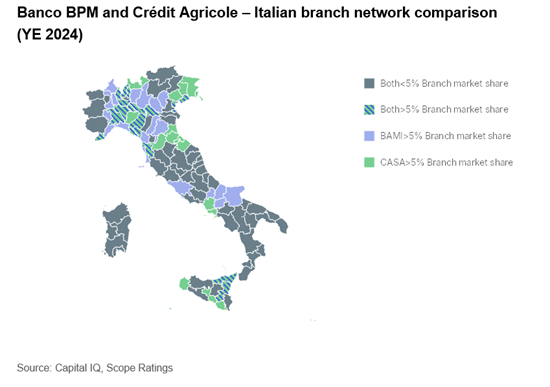

A merger between BPM and CA Italia would create a strong group with a well-diversified business model, substantial scale (total assets exceeding EUR 300bn, and a loan market share close to UniCredit’s) and a geographical presence centred on Italy's wealthiest regions. The deal could be supported by a number of factors:

• Unlike in the MPS-Mediobanca deal, both groups operate as universal banks, offering comprehensive and complementary services across banking, wealth management and insurance. Banco BPM’s lending portfolio is geared towards business clients, while Crédit Agricole Italia’s is more tilted towards retail customers.

- Their branch networks overlap in Lombardy, Veneto, Tuscany and Sicily, offering the potential for cost cutting, even though both banks have already streamlined their physical presence: -38% by Banco BPM, -30% by Crédit Agricole between 2017 and 2024.

- CA and BPM have joint ventures in non-life insurance and consumer credit; Crédit Agricole owns more than 60% in both cases.

- A deal could be set up as a friendly merger, which would reduce (but not eliminate) execution risk.

A merger would likely result in a complex shareholder structure, with potentially adverse implications for governance and strategy. Although Banco BPM’s shareholders are likely to retain a majority stake, we expect Crédit Agricole to become the largest minority shareholder, with a stake of over 40%. This could trigger some political resistance, particularly in light of the precedent set in UniCredit-Banco BPM negotiations. Indeed, we see the Italian government reactivating the 'Golden Power' to impose restrictions, particularly on lending and investment.

Another potential issue would be the complexity of integrating the two groups' wealth management and bancassurance activities. Banco BPM recently acquired asset manager Anima and has a life insurance subsidiary, BPM Vita, whereas CA Italia distributes services from its parent group's specialised subsidiaries, including Amundi.

MPS, BPER takeover bids successful

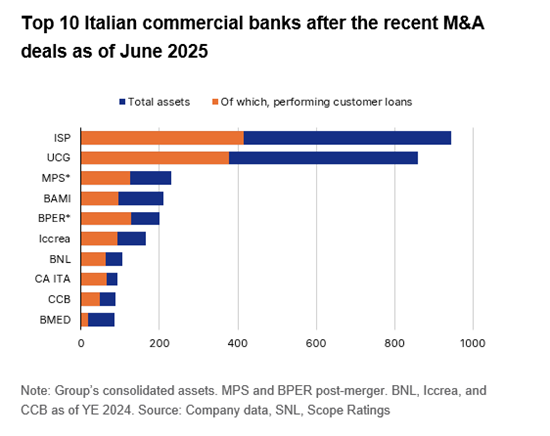

MPS had secured around 86.3% of Mediobanca’s shares by mid-September, surpassing the two-thirds threshold required for extraordinary shareholder decisions and making a full merger likely. The deal is partly a response to long-standing government pressure to establish a strong third national champion behind Intesa (A/Stable) and UniCredit (A/Stable).

The merged entity will retain a significant 13% stake in insurer Assicurazioni Generali and strengthen its position in banking, wealth management and insurance. From a credit perspective, the enlarged group benefits from a highly diversified revenue base, MPS’s EUR 2.9bn in deferred tax assets (to be released over six years with an estimated annual after-tax benefit of EUR 500m) and projected annual synergies of EUR 700m, largely from cross-selling, cost optimisation and lower financing costs.

After its Mediobanca acquisition, MPS has become Italy’s third-largest banking group by total assets and fourth largest by customer loans. The operation is structured as a “plug-in” deal, where both banks will maintain their brand identities and operational independence for the time being.

Meanwhile, BPER secured more than 80% of BPSO’s share capital over the summer, paving the way for a full merger by year end. This transaction consolidates BPER’s presence in Lombardy, positioning it as the country’s third-largest bank by customer loans, with total assets of around EUR 200bn and revenues exceeding EUR 7bn. Scope upgraded BPSO’s issuer rating to BBB+/Stable from BBB/Positive on 15 July, reflecting the benefits of its integration into the stronger BPER group.