Announcements

Drinks

EU Banks NPL Heatmaps: poor economic outlook, high corporate NPLs in core countries underpin caution

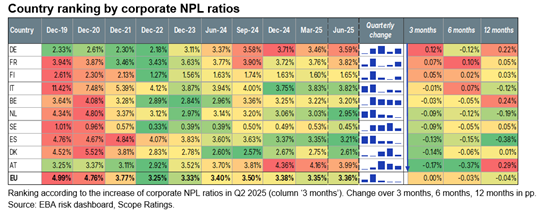

Although corporate NPL ratios remain high, they were stable in Q2 at. 3.4%. But while Austria and Denmark saw notable reductions of 17bp and 14bp, respectively Germany, France and Finland saw their ratios rise. Spain has seen a gradual improvement in recent years.

In the second quarter, the overall NPL ratio remained stable at 1.84%. With few notable exceptions, quarter-on-quarter changes at country level were in the order of a few basis points. Germany, France and Denmark saw the largest quarterly increases; Spain, the Netherlands and Italy continued their downward trend of the past year.

From a sector perspective, there was mild worsening in wholesale and retail trade, and real estate in Q2. The deterioration in wholesale and retail trade NPLs was most pronounced in Germany, where the sector NPL ratio rose by 40bp. Real estate NPLs increased marginally during the quarter, amounting to 2.8% in Q2 2025, while the manufacturing NPL ratio saw a significant improvement, dropping to 3.8% from 4% in Q1.

At EU level, Stage 2 loans edged down slightly to 9.4% in Q2 2025. Dispersion by country is high, though, with Germany and Austria well into double digits. Notable improvements were observed in the Netherlands and Denmark, with declines of 70bp and 50bp respectively, while Belgium and France showed some deterioration.

Having spiked in Q1 at 57bp, cost of risk for the EU banking sector dropped back to 48bp, in line with the pre-tariff range of 45bp-50bp within which it has oscillated since Covid.