Announcements

Drinks

Norwegian savings banks: equity capital structure proposals will have limited credit implications

By Magnus T. Rising, Financial Institutions

Both follow from the government-appointed Norwegian Savings Bank Commission’s recommendations in response to the European Banking Authority’s concerns about whether equity capital certificates (ECCs) issued by Norwegian savings banks satisfy regulatory requirements for CET1 capital.

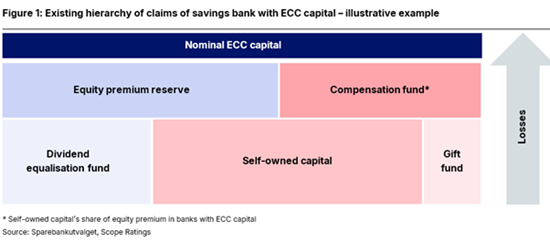

The EBA’s primary concern is that ECC capital ranks above self-owned, or so-called ownerless, capital in the hierarchy of claims if the self-owned capital and the gift fund are, in aggregate, greater than the dividend equalisation fund (Figure 1). Self-owned capital includes a bank’s original capital paid in when the bank was established, but it mainly consists of retained earnings. Under existing rules, ECC capital and self-owned capital both count toward CET1 capital.

In a worst-case scenario, assuming no regulatory amendments, the EBA would undertake a closer evaluation of ECCs and could remove them from its list of eligible CET1 instruments. If ECCs no longer qualify as CET1 instruments, a significant number of savings banks would need to take extraordinary measures to meet their capital requirements. This might entail conversion to joint stock companies, in which case current ECC capital would become share capital and qualify as CET1.

However, such an outcome is unlikely in our view. In a letter to the Norwegian FSA in May, the EBA emphasised an interactive approach with the local competent authority and stressed that it has never to-date exercised its discretion to remove CET1 instruments from the list. We anticipate that Norwegian policy makers would implement the statutory amendments required if the EBA were to maintain its position on the eligibility of ECCs as CET1 instruments.

The equity share model

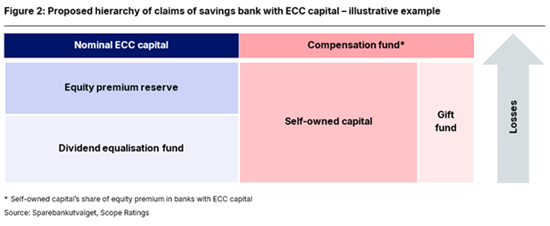

Under the equity share mode (ESM), the Savings Bank Commission’s key recommendation (Figure 2), ECC capital will rank pari passu with self-owned capital and require the creation of nominal ‘self-owned capital shares,’ effectively synthetic ECCs.

These will be a legal construct, though, and will not be issued to any owner. ECCs and primary capital shares will be treated as two classes of the same instrument. The ECC ratio will be calculated by dividing the number of ECCs by the number of ECCs plus the number of self-owned capital shares.

No impact on loss absorption capacity from adjusting priority of ECCs in equity capital structure

Linking self-owned capital with synthetic self-owned capital shares ranked pari passu with ECCs will not influence the capital loss-absorption capacity of savings bank capital. Despite the EBA’s concerns, it is important to note that under current Norwegian legislation, ECCs are intended to function as shares for both issuers and investors. They are perpetual in nature and take losses before hybrid and debt instruments, including AT1s.

Dividends are paid out of net income and MDA trigger levels apply in the same way they do for other regulated banks, so as far as the hierarchy of claims is concerned, the proposed adjustment to the capital structure will have no impact on the credit risk of savings banks’ debt instruments.

Maintaining cap on equity investors’ representation on supervisory boards unsupportive

Under existing rules, the higher ranking of ECC capital compared to self-owned capital can be seen as compensation for the fact that ECC representation on savings bank supervisory boards is limited by statute to a maximum of 40%. Despite the Commission’s proposal to have ECC capital and self-owned capital rank pari passu, it would at the same time like to maintain the cap on ECC representation, even though this is not a pre-requisite for the proposed ESM framework.

In line with the savings bank tradition, this is intended to preserve the ‘vote’ of the self-owned or ownerless capital for depositors, employees and, in some instances, local Government representatives. Maintaining the cap on ECC investor representation despite the change in priority may have a negative impact on the market value of equity and the ability of savings banks to raise equity in distressed situations. Consequently, this part of the policy proposal could have negative credit implications.

Following the change in priority, ECC investors will be the ultimate residual claimants along with the self-owned capital, so there is a strong case for ECC investors ultimately being able to control the bank, especially where the ECC ratio exceeds 50%. In this case, we would not expect financial management of the banks to materially diverge from historical trends. Compared with savings banks elsewhere, Norwegian savings banks that have issued ECCs tend to already optimise their financial management and operate with ambitious return on equity and dividend payout targets.

As we have previously highlighted (see link below), the limited representation of ECC investors is a key factor preventing a faster pace of sector consolidation. Since savings bank mergers have generally been credit positive, maintaining this structural brake on strategic M&A activity may limit the credit strengthening of the sector over the long-term.

Positive credit implications from less dilution of ECC capital when ECCs are issued at a discount

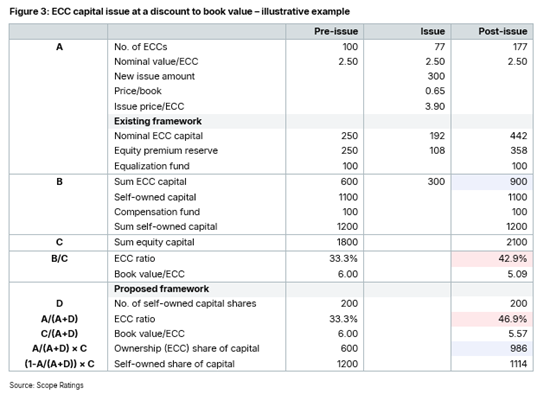

An equity issue priced at a discount to book value will be more attractive to equity investors under the proposed framework than the existing equity capital structure. Since this should enhance the capacity of savings banks to issue equity in distressed situations, it will be nominally supportive of credit quality.

In the event that ECCs are issued at a discount to book value with the existing framework, self-owned capital is allocated a share of equity as if the ECC issue were priced at book value. This implies a transfer of value from ECC investors to self-owned capital. The proposed ESM, on the other hand, is neutral in that synthetic self-owned capital shares will be equivalent to ECCs (Figure 3). If ECCs are issued at a discount, self-owned capital will be diluted in the same way as existing ECC capital.

Compared with the current framework, both existing and new ECCs will have a higher share of total equity post-transaction. This should support the ability to raise equity capital in distress, which can be a key action to prevent failure.

See also: Norwegian bank M&A: Savings bank consolidation a long-term trend with positive credit implications.