Announcements

Drinks

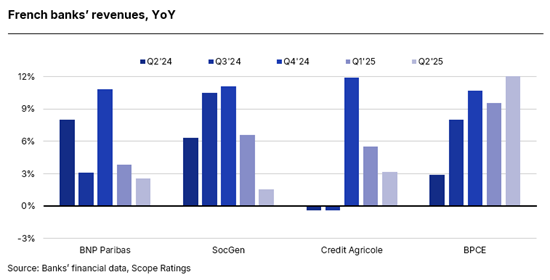

French banks quarterly: political vulnerabilities cloud uncertain year-end

The recent widening of French government bond spreads to record highs is likely to increase banks’ refinancing costs in coming quarters, which could pressure profitability, especially as French banks are among the largest debt issuers in Europe. “While most banks have largely completed their planned funding for this year and this should mitigate the impacts in coming quarters, the effects of higher spreads on a permanent basis could erode expectations for further profitability improvements in 2026,” said Carola Saldias Castillo, lead analyst for French banks.

“A sustained widening of French government bond spreads could also increase capital volatility, especially for banks that maintain optimised capital strategies,” Saldias Castillo continued. This is due to the banks’ large direct holdings of sovereign debt plus indirect exposures through their insurance subsidiaries – between EUR 40bn to EUR 100bn for the country’s four largest banks, representing between 40% and 150% of CET1 capital.

“Any further erosion of market confidence could slow the growth in French banks’ lending volumes expected for the fourth quarter,” Saldias Castillo noted. The positive trend in residential mortgages, corporate and SME loans since early 2025 already reversed in August, with the largest effect on mortgages. “French banks were able to improve their return on risk-weighted assets in Q2 but it still lagged the performance of peers in Italy and Spain”.

We expect asset quality for the full year to show some early signs of deterioration, with higher NPLs for most banks, reflecting the volatile economic environment and the structurally higher risk in consumer lending and SMEs, which will weigh on provisions.

Notwithstanding the challenges, we have Stable outlooks on our public ratings on BNP Paribas (AA-/Stable) and Credit Agricole (AA-/Stable), reflecting also our expectation that risks to their credit profiles remain broadly balanced.

Download the full report here.

Scope has public ratings on BNP Paribas and Crédit Agricole:

- Scope affirms and publishes BNP Paribas’ AA- issuer rating with Stable Outlook, December 2024

- Scope affirms and publishes Credit Agricole SA’s AA- issuer rating with Stable Outlook, December 2024

Scope also has subscription ratings on Banque Fédérative du Crédit Mutuel, BPCE, and Société Générale. To view the ratings and rating reports on ScopeOne, Scope’s digital marketplace, or to register, please click on the following links: