Announcements

Drinks

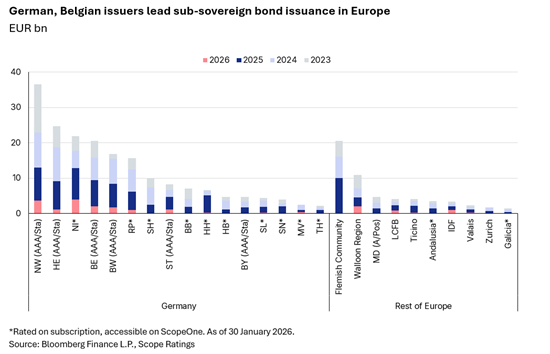

European sub-sovereign outlook: risks remain balanced overall despite diverging credit trajectories

Sub-sovereign credit profiles will continue to benefit from supportive institutional frameworks, predictable transfer mechanisms and sovereign support, which underpin funding access and debt affordability, Scope Ratings says in the rating agency’s new sub-sovereign outlook.

“Easing inflation and interest-rate pressures provide some relief, but we expect fiscal trends to diverge in the medium term due to a variety of factors, including the impact of demographic pressures and rising investment needs, budgetary flexibility, particularly among issuers with structurally weaker finances,” says Jakob Suwalski, Executive Director, Sovereign & Public Sector and lead author of the report.

At the EU level, the reformed fiscal framework increases focus on implementation credibility, raising execution risk in countries with high sub-sovereign debt. As NGEU/RRF funding programmes near completion, greater scrutiny of the quality and sustainability of post-RRF investment is likely to further differentiate credit trajectories.

Germany’s Länder debt ratios to stabilise after recent declines

In Germany, the Länder will retain benchmark credit quality supported by a strong institutional framework, federal backing and robust market access. Nonetheless, budgetary pressures are set to persist, with heterogeneous fiscal positions and continued reliance on debt-brake flexibility.

Aggregate debt ratios are likely to stabilise rather than resume their pre-2020 downward trend, and spillover risks from structurally weak municipalities will remain a key credit consideration.

Favourable macro-economic context supports Spanish issuers

“We expect Spanish regions to benefit from a favourable macro-economic momentum in 2026. Fiscal outcomes will remain uneven due to varying social spending pressures and structural features of the regional financing system,” says Suwalksi.

Debt-relief measures and financing reforms may improve market access, though implementation risks remain, while a gradual return to market funding under differentiated access regimes is expected over 2026–28.

Sovereign-linked factors create more mixed outlook in Belgium, France, Italy

In Italy, limited fiscal autonomy and pressures of continued budgetary consolidation are likely to cap local rating upside despite supportive sovereign dynamics.

In France and Belgium, sovereign consolidation strategies, elevated spending pressures and moderate revenue growth are expected to continue weighing down on sub-sovereign budgetary metrics, particularly among entities with limited fiscal flexibility.

Investment pressures grow in Norway and Switzerland

Outside the euro area, Norwegian counties and cities face continued operating and investment pressures in 2026; however, restructuring measures within a strong institutional framework and reliable access to state-backed funding support the gradual adjustment and preserve debt affordability, even as debt levels rise.

Finally, Swiss cantons will further benefit from high revenue flexibility and conservative financial management, underpinning stable credit profiles despite rising spending needs.