Announcements

Drinks

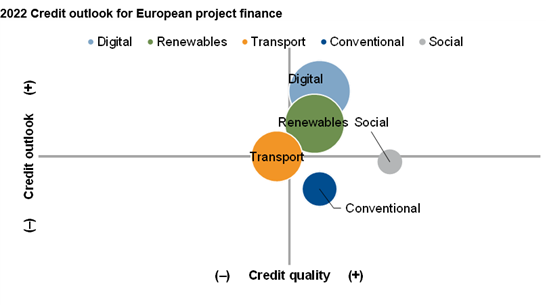

Mixed credit outlook for European infrastructure and project finance

“Our overall credit outlook for the conventional power space is negative, largely because conventional generators such as coal and gas-fired power plants face multiple challenges in an environment where Europe embraces the energy transition, although specific facilities in certain markets can remain profitable,” said Torsten Schellscheidt, head of project finance ratings at Scope.

Scope’s credit outlook for renewable energy projects, by contrast, is positive. “We expect robust investments in this segment supported by recovering electricity demand,” said Aaron Konrad, executive director in Scope’s project finance team. Despite falling global electricity demand in 2020, renewable energy capacity grew by 10% and added another 10% in 2021 with overall electricity demand growing by 4.5%. “Solid performance and robust investments in the renewable energy space will also be supported by the sector’s resilience to economic shocks, and its improving competitive position versus conventional power generation,” Konrad added.

While the credit outlook for the European transportation sector is stable, the prospects for sub-sectors and geographies are mixed. “Passenger transportation is still running below pre-pandemic usage levels and this situation will persist in 2022. Goods transportation has seen stable or is seeing increasing demand, although the pandemic has exposed significant bottlenecks in global supply chains,” Schellscheidt said.

On digital, even though the digitalisation of advanced economies has been well underway for over a decade, the pandemic significantly accelerated this trend hence Scope’s outlook continues to be positive for this year. “The emergence of social distancing, lockdowns and remote working in the wake of the pandemic has been a boon for digital infrastructure, particularly in the most data-driven economies,” Konrad said. “The need for connectivity has grown massively, supported by political tailwinds such as the European Commission’s Digital Europe Programme, and has resulted in pent-up demand for digital infrastructure including fibre, telecom towers, active networks, and data centres.”

Scope’s credit outlook for social infrastructure is stable. Investment in social infrastructure and public-private-partnerships continues to be muted due to public spending constraints. “Muted sector activity sharply contrasts with the urgent need to build new social infrastructure as the gap between long-term demand for healthcare and other social services and investment continues to widen,” Schellscheidt said.

Size of circles indicates issuance volume of sector

*Source: Inframation, Scope Ratings

Download Scope’s 2022 Project Finance Outlook here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.