Announcements

Drinks

France: growth slows as repercussions of Russia-Ukraine conflict darken inflation and fiscal outlook

By Thomas Gillet, Associate Director, Sovereign and Public Sector

By Thomas Gillet, Associate Director, Sovereign and Public Sector

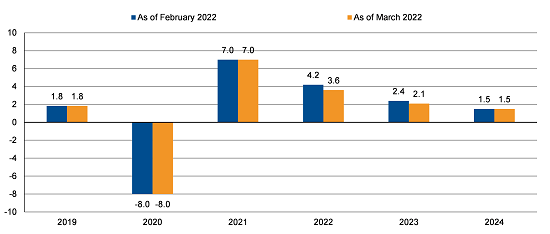

Our baseline economic forecast for France (AA/Stable) is for a more modest recovery with real GDP growth of 3.6% in 2022 (-0.6pp) and 2.1% in 2023 (-0.3pp), as growth slows across the euro area.

In a more stressed scenario, with even higher and more long-lasting price pressures, growth would slow more significantly. However, we assume that the energy price shock will be temporary, given futures on oil and gas prices indicate a downward trend over the next 12 months.

France’s real GDP growth – baseline scenario

Source: Scope Ratings GmBH

One of the main reasons for adverse knock-on effects of Russia’s invasion of Ukraine for France is the pressures the government faces to mitigate the impact of rising inflation and to increase defence spending just as the economic recovery from the Covid-19 crisis has started to slow. The extra expenditure puts pressure on France’s public finances, which have substantially deteriorated in the context of the Covid-19 crisis, leaving the country with limited room to increase spending further. France’s public debt reached around 115% of GDP in 2021, up from 98% of GDP in 2019.

The government announced a new package of measures aimed at providing relief to households and firms hit by rising energy and other prices on 16 March including a discount of 15-euro cents a litre on petrol between April and July, energy-price related subsidies to firms and strengthening state-backed corporate liquidity facilities. Including previously introduced support since last September, these measures amount to an estimated cost of EUR 25bn (around 1% of GDP). The government has also started discussions on an increase in civil service salaries in response to rising inflation.

France does have the advantage, compared with Germany in particular, of its relatively low reliance on oil and gas imports, given Electricité de France’s large park of nuclear power stations, which helps contain inflation compared with the rest of the euro area and should cap any additional government compensation for households and business.

France’s price protection: inflation in major euro area countries, January 2022

% YoY

Source: Eurostat, Scope Ratings GmBH

However, France faces other upward pressure on public expenditure. In terms of defence spending, the war in Ukraine has led to a rethink across Europe about military budgets. Following the Germany’s announcement to lift spending, partly through a EUR 100bn defence fund, the French government plans to further increase its defence budget. The French multiannual defence plan had already foreseen increasing its defence spending to 2.0% of GDP by 2025, before the war in Ukraine. The defence budget stood at EUR 39.2bn (1.6% of GDP) in 2021. Most candidates running in next month’s presidential election have pledged to increase defence spending, including President Emmanuel Macron.

France faces longer-term spending challenges too, most notably to meet emissions-reduction targets, enhance digitalisation and rising welfare costs related to the country’s ageing population.

Beyond the fiscal costs, the war in Ukraine is also weighing on France’s economic outlook due to a deteriorating external environment and weaker business and consumer confidence. Weaker economic performance of major trading partners in the euro area such as Germany (AAA/stable), for which we revised down our growth forecast to 3.5% (-0.9pp) in 2022, will weigh on demand for France’s exports.

France is less exposed to direct risks from the war and sanctions on Russia given less commercial and financial exposure to Russia and Ukraine compared with most euro area countries. However, much still rides on negotiations at the European level surrounding the funding of these long-term challenges, including the reform of EU fiscal rules, and the French government’s ability to offset spending pressures with cost savings or revenue-side measures critical to mitigate pressures on France’s credit outlook.

Thibault Vasse, Senior Analyst, and Brian Marly, Associate Analyst, contributed to this commentary.