Announcements

Drinks

Italy’s sovereign bond market is resilient to gradual quantitative-tightening

The ECB’s accommodative monetary policy was instrumental in ensuring highly favourable financing conditions for Italy, especially during the Covid-19 pandemic. Now, however, high inflation points to a turnaround in the monetary policy stance, though the ECB will have to contend with the significant economic ramifications of Russia’s invasion of Ukraine on inflation and growth in Europe.

In its March meeting, the ECB confirmed its decision to halt net asset purchases under the PEPP program by March of this year and communicated its readiness to also halt net asset purchases under the PSPP in the third quarter if the medium-term inflation outlook does not weaken.

“The latest ECB decisions signal that monetary policy normalisation could happen faster than previously expected,” says Alvise Lennkh, deputy head of sovereign and public sector ratings. “Even in this updated scenario, our estimates of ECB asset purchases and Italy’s funding needs signal that the ECB’s role in the Italian bond market will remain supportive through the reinvestment phase, likely limiting the amount of annual bond issuance to be absorbed by private investors to below or in line with historical peaks.”

Italy government debt, by holder sector

Source: Banca d’Italia, Scope Ratings GmbH

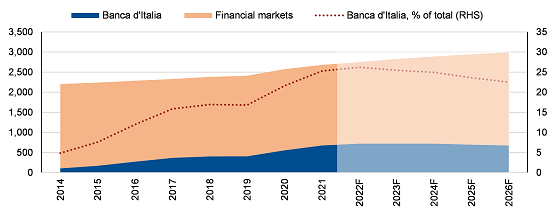

The PEPP and PSPP supported demand for Italian government bonds in the secondary market, lowered borrowing costs for the Italian Treasury and resulted in a large transfer of government debt to the central bank’s balance sheet. “Net asset purchases have been so significant to even reduce the amount of Italian debt held by the private sector,” says Lennkh.

Annual asset purchases of Italian government securities by the ECB – including net purchases and the reinvestment of maturing principal – are set to decrease from about EUR 180bn in 2021 and EUR 210bn in 2020 to around EUR 90bn this year on current economic projections. This would result in the annual volume of long-term issuance that needs to be absorbed by financial markets to reach approximately EUR 215bn this year, which is significantly above our estimates in 2020-21, but still below levels in 2019 of about EUR 225bn.

“The ECB’s supportive role will remain material also in the following years, thanks to the continued reinvestment of its maturing debt holdings. This will likely curtail the volume of annual long-term issuances by the Italian Treasury absorbed by financial markets below or in line with 2014 levels of EUR 272bn over the coming years, limiting pressures on financing costs for Italy,” says Giulia Branz, analyst at Scope.

Nevertheless, pressures on the capacity of households and the banking sector to absorb government securities are likely to emerge longer term in the absence of significant fiscal consolidation.

“Such annual volumes of issuance would need to be absorbed in the context of a rising outstanding stock of debt held by the private sector,” says Branz.

Scope estimates that so long as PSPP reinvestment continues, debt securities corresponding to a deficit of about 2.5% of GDP could be absorbed by the ECB. Without reinvestment, the private sector would need to absorb the highest annual levels of Italian issuance to date, even assuming a balanced budget for Italy, which is not Scope’s baseline.