Announcements

Drinks

European corporate credit outlook: Ukraine war strains supply chains, threatens price shock

“Rising inflation will favour sectors that can pass-through costs, possess pricing power and/or have inelastic demand. Supply-chain disruptions will bite across the board, affecting cyclical sectors the most severely,” says Dierk Brandenburg, head of credit and ESG research at Scope.

Partially offsetting these adverse trends will be catch-up spending by households after the pandemic, rising capital expenditure, and generally improving corporate balance sheets, says Brandenburg, commenting on Scope’s Q2 Corporate Credit Outlook

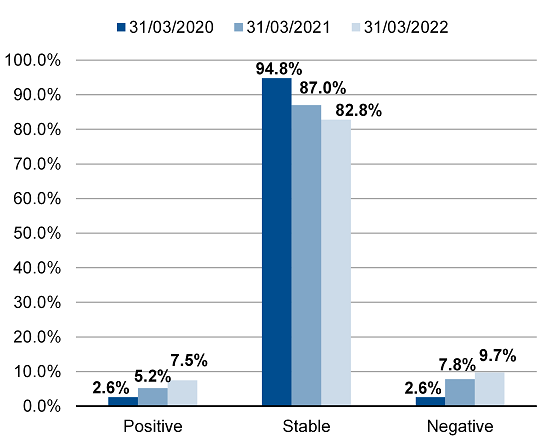

. Distribution of Scope Ratings’ corporate credit outlooks Q1 2022

This in general favours sectors with either inelastic demand (e.g. utilities, health care, consumer staples) and/or sectors with high pricing power. They include pharmaceuticals, healthcare, consumer staples, IT, telecommunications, discretionary consumer goods and real estate – all likely beneficiaries of a more inflationary 2022. On the other end of the scale are industrial, materials and energy companies which may struggle to pass on higher input costs to customers.

“Supply chain issues will persist into at least mid-2022,” says Thomas Faeh, executive director in corporate ratings at Scope. “While slower economic growth and softer demand should ease this topic, the war in the Ukraine is affecting certain trade routes and goods, and global supply chains remain vulnerable,” Faeh says. Orders were strong in the manufacturing sector in 2021 and disrupted supply chain led to a depletion of inventories.

“The combination of high energy prices, lower economic growth and increased interest rates in addition to supply-chain disruptions points to downside risk for profit margins at firms in cyclical sectors like automobiles and construction in the short-term,” he says.

Scope expects to see bigger shareholder pay-outs and more debt-financed mergers and acquisitions, after record deal-making in 2021, which also have implications for corporate credit quality this year.

“We have seen several examples in our rating universe where such corporate actions have not just led to a temporary deterioration of credit metrics, but the negative impact was significant enough for a negative rating action,” says Faeh. More nuanced is the outlook for capital expenditure, set to vary hugely by sector

Overall, Scope’s corporate credit ratings declined slightly during the pandemic, with the median corporate moving from BBB+ towards BBB. More importantly, Scope’s credit ratings outlooks have moved towards a diverse picture of more positive as well as negative outlooks.

Around 9.7% of our corporate credit ratings outlooks are negative, with the largest portion stemming from hard hit sectors like airlines and retail real estate that also have seen most of the downgrades. Consumer goods, grid utility companies and in several smaller corporates also have negative outlooks.

An increasing proportion of companies – now standing at 7.5% – has positive credit ratings outlooks, mostly within pharmaceuticals and business services. However, outlooks also improved across the corporate spectrum for companies which have emerged strongly from the pandemic.