Announcements

Drinks

EU’s oil embargo proposal strikes delicate balance; Hungary risks further isolation

By Jakob Suwalski, Director, and Thomas Gillet, Associate Director, Sovereign Ratings

The step-by-step oil embargo proposed by the European Commission exempts Hungary (BBB+/Stable) and Slovakia (A+/Stable) from immediate compliance, as the two countries may have until December 2023 to stop importing oil from Russia, assuming member states reach the unanimous agreement needed for the measures to go into effect.

The European Commission’s proposal is backed by most EU members, including Germany (AAA/Stable), but Hungary has proven harder to convince given Prime Minister Viktor Orbán’s refusal to support the planned oil embargo and the country’s dependence on Russia for energy, also an issue for some other central and eastern European countries.

The tough stance taken by Orbán constitutes another foreign policy milestone that risks driving Hungary further into isolation, as confrontation between Budapest and Brussels continues following the recent triggering of the EU’s conditionality mechanism against breaches of the rule of law.

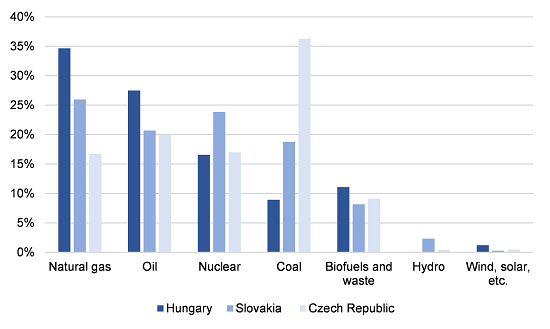

Hungary, Slovakia, and Czech Republic have fossil-fuel heavy energy mix

Total energy supply by sources, %

Note: average for 2010, 2015, and 2020

Source: International Energy Agency, Scope Ratings

Hungary and Slovakia depend on Russia for more than 70% and 95% of total oil imports on average, respectively, hence the EU’s concern to avoid substantial near-term disruptions of their fuel supplies. To a lesser extent, other countries such as the Czech Republic (AA/Stable) could also seek an exemption, given relatively high dependence on Russia (around 50% of total oil imports).

With its embargo plan, the EU has proposed short-term measures to address energy security and medium-term measures to address the long-term issue of dependency on Russian energy and need for further energy-sector investment.

The 12- to 18-month delay granted to Hungary and Slovakia should enable the authorities to gradually diversify suppliers, which is easier for oil than natural gas. Nonetheless, phasing out Russian crude oil will also require modernising local refining capacity to process different types of crude oil. In that respect, we expect large investments in infrastructure projects from energy companies in Hungary and Slovakia, which will likely take years to be completed.

Beyond the volume of oil supply, it is likely that the Hungarian and Slovak authorities will introduce further measures to offset the impact of higher oil prices on households and business, as the EU embargo may push up oil prices and stoke inflation.

However, longevity to apply exemptions for selected countries by the EU and provision of some short-term relief for Hungary and Slovakia will also depend on any countermeasures from Russia which could still materially disrupt energy supplies to Europe including natural gas. On May 3, the Putin signed a decree imposing retaliatory measures targeting "unfriendly countries," with further details expected within 10 days.

We see a growing risk that Russia stops oil supplies to some EU countries and/or target primarily the most vulnerable countries benefiting from a temporary exemption following Russia’s decision to halt gas supplies to Poland and Bulgaria.

We have revised our growth forecasts for Hungary and Slovakia to 3.5% and 2.5% in 2022, from 5.4% and 5.3% respectively, given rising uncertainty and inflationary pressure triggered by the Russian invasion, high dependence on Russian oil and gas, as well as potential Russian retaliation.